Market Picture

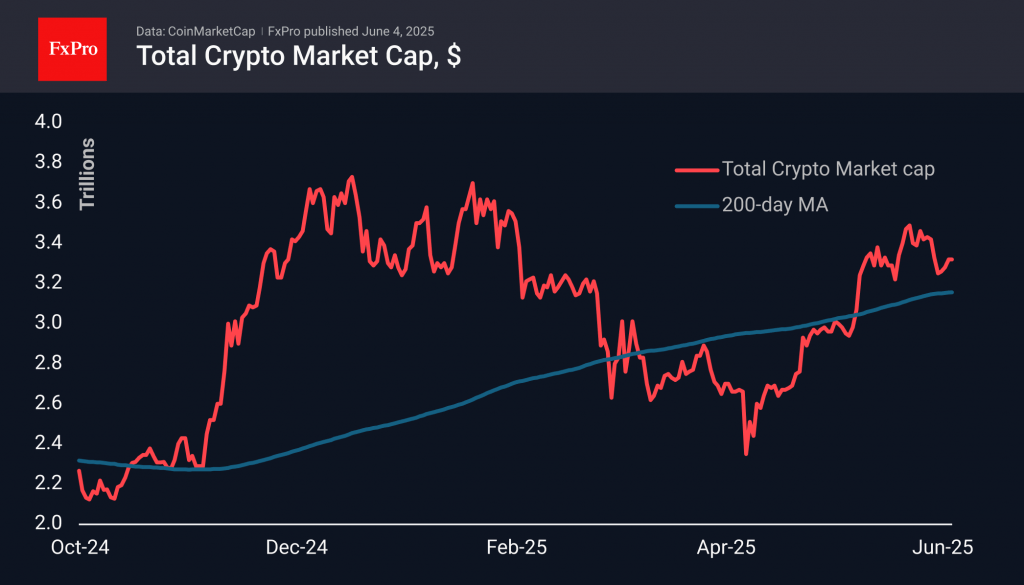

The market capitalisation, at $3.32 trillion, remains roughly the same as the day before. With the start of the new month, there is a visible upward trend with a sequence of higher local highs, although the market is more than 3% lower than it was seven days ago.

The cryptocurrency sentiment index remains in greed territory at 62, although it has lost a couple of points over the day. This cooling does not interfere with the local positive trend but indicates a moderate pace of growth.

Bitcoin is trading above $105K, rebounding from lows near $103K on 31 May. This looks like the beginning of an upward movement from the mid-May consolidation area. Potentially, this momentum could take the market to new highs above $130K.

Ethereum continues to struggle with its 200-day moving average, unable to consolidate above it. However, the overall positive background allows bulls to seize the initiative on downward pullbacks quickly. As was the case three and a half weeks ago, breaking through $2,700 will be an important signal that the coin has moved from consolidation to growth. In turn, this could be an important indicator of renewed optimism for the entire cryptocurrency market.

News Background

According to Cryptoquant, Bitcoin could correct to $96,700. This level corresponds to the average purchase price of short-term investors. Bitcoin Magazine is also not optimistic about Bitcoin’s short-term prospects.

Strategy has announced the issue of 2.5 million preferred shares with a 10% dividend yield. The funds raised will be used to purchase the first cryptocurrency.

Hong Kong-based Reitar Logtech Holdings intends to purchase $1.5 billion worth of Bitcoin as a hedge against volatility in traditional markets and to increase financial stability. No specific purchase dates have been announced.

Binance founder Changpeng Zhao has discussed the risks associated with the widespread creation of corporate reserves based on Bitcoin. According to him, they are ‘non-binary and range from 0 to 100.’ However, with the right balance, it is possible to achieve an optimal risk/return ratio.

The FxPro Analyst Team