Market Overview

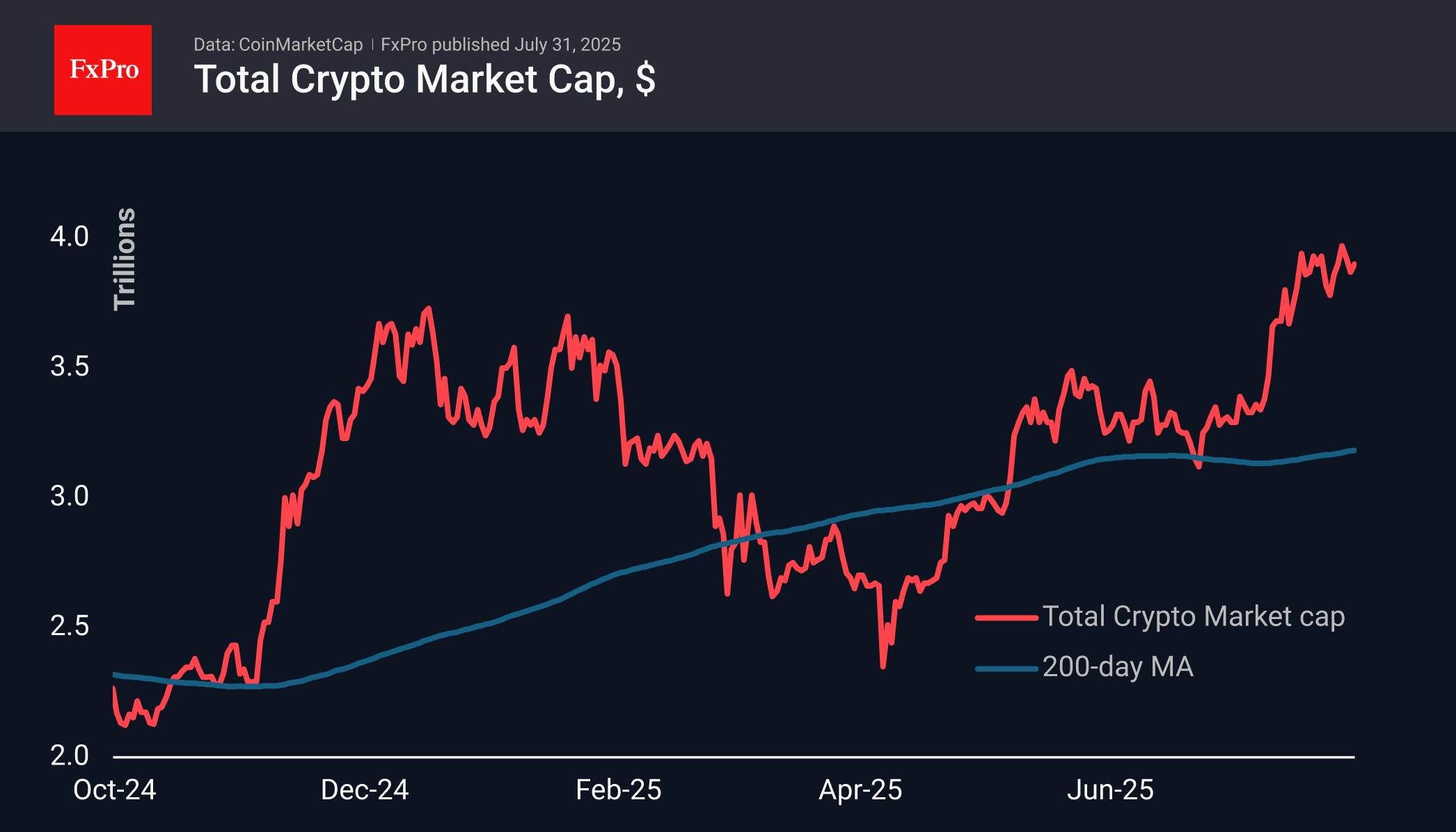

The crypto market capitalisation rose 0.5% during the day to $3.90T, following the reversal of the stock markets and Bitcoin at the end of the day on Wednesday, after falling to $3.79T immediately after the Fed’s announcement on the key rate. The influence of macroeconomic factors on cryptocurrencies continues to grow, even in the absence of major industry developments — a trend that can also be seen as part of the market’s maturation.

Bitcoin bulls once again defended the lower boundary of the range, which has been holding for almost three weeks, preventing the price from settling below $116K on Wednesday evening. A powerful buying momentum brought the price back to the $118.6K area. But the market still needs drivers to storm $120K. The US White House report on the development of digital assets did not contain any details that could inspire new buyers, making the crypto market follow the trends of macroeconomics and traditional finance.

News Background

According to Glassnode, for the first time since April 2023, Ethereum has reached 40% open interest in the derivatives market, while Bitcoin’s dominance is showing a decline.

Bernstein believes that large companies are increasingly choosing Ethereum over the first cryptocurrency as an investment vehicle, as ETH offers an income-generating tool such as staking.

The US SEC has begun reviewing an application from BlackRock, the world’s largest investment company, to stake Ethereum held in its ETH ETF.

Asian countries are tightening crypto regulations. The Bank of South Korea (BoK) has created a new division to monitor the crypto market. Indonesia has announced tax increases on cryptocurrency transactions, and Hong Kong has finalised rules for stablecoins.

Algeria has banned all cryptocurrency transactions, including exchange, storage, and mining. Violators of the new rules face fines and imprisonment.

Crypto lender Abra has suddenly suspended withdrawals for international customers. The crypto community fears that the platform may repeat the fate of the bankrupt Celsius and BlockFi.

The FxPro Analyst Team