Market picture

The crypto market has been enjoying an influx of buyers since Saturday, with a visible acceleration on Monday. Over the past 24 hours, capitalisation has risen 3.6% to $2.33 trillion. Last week’s drop in the crypto sentiment index to 30 (fear zone) reversed the price twice, showing that the market is dominated by a ‘buy the dip’ pattern.

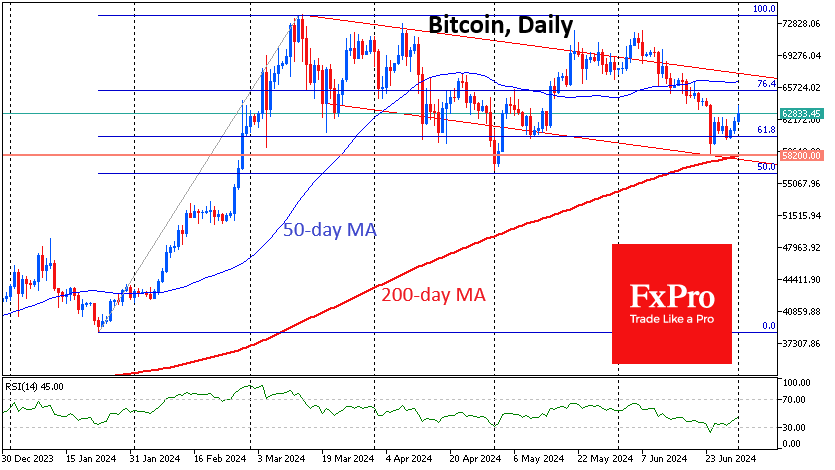

Bitcoin is trading near $63.3K, adding 5% since Saturday morning and reaffirming the importance of the 61.8% retracement of the Jan-March rally. From another perspective, Bitcoin is adding and bouncing off the lower boundary of the downward channel. Likely, the price is now moving towards the upper boundary at $67K. However, cautious buyers may prefer to wait for confirmation with the price rising above $72-73K – the pivot area of the last four months – which would be confirmation of the start of a new impulsive wave of growth.

Bitcoin ended June down 8.5% to $61.9K. In terms of seasonality, July is considered quite successful for BTC, adding eight times (22.3% on average) out of the last 13 and declining on five occasions (-7.8% on average).

News background

Ethereum-ETFs will not begin trading in early July. The SEC has returned Forms S-1 to potential issuers of spot ETH-ETFs for corrections. The regulator expects corrected filings to be returned by 8th July.

CryptoQuant recorded an easing of Bitcoin miner sales pressure. The end of these sales could set the stage for a resumption of the rally, and this could happen in Q3.

According to Santiment, the level of bullish sentiment on social media has significantly decreased, and traders have lost confidence in the markets. This can be seen as one factor in Bitcoin reaching a possible bottom.

The SEC sued ConsenSys, the developer of the MetaMask wallet. According to the agency, the firm violated the law by selling unregistered securities through the MetaMask Staking service.

VanEck Investment Company filed a form with the SEC to register a spot ETF based on the Solana cryptocurrency (SOL). Swiss company 21Shares also filed the same application with the SEC a little later. According to Bloomberg, the chances of approval of SOL-ETF after the pre-election debates in the U.S. have increased. The new president and the change of the head of the SEC may change the situation.

The FxPro Analyst Team