Market Picture

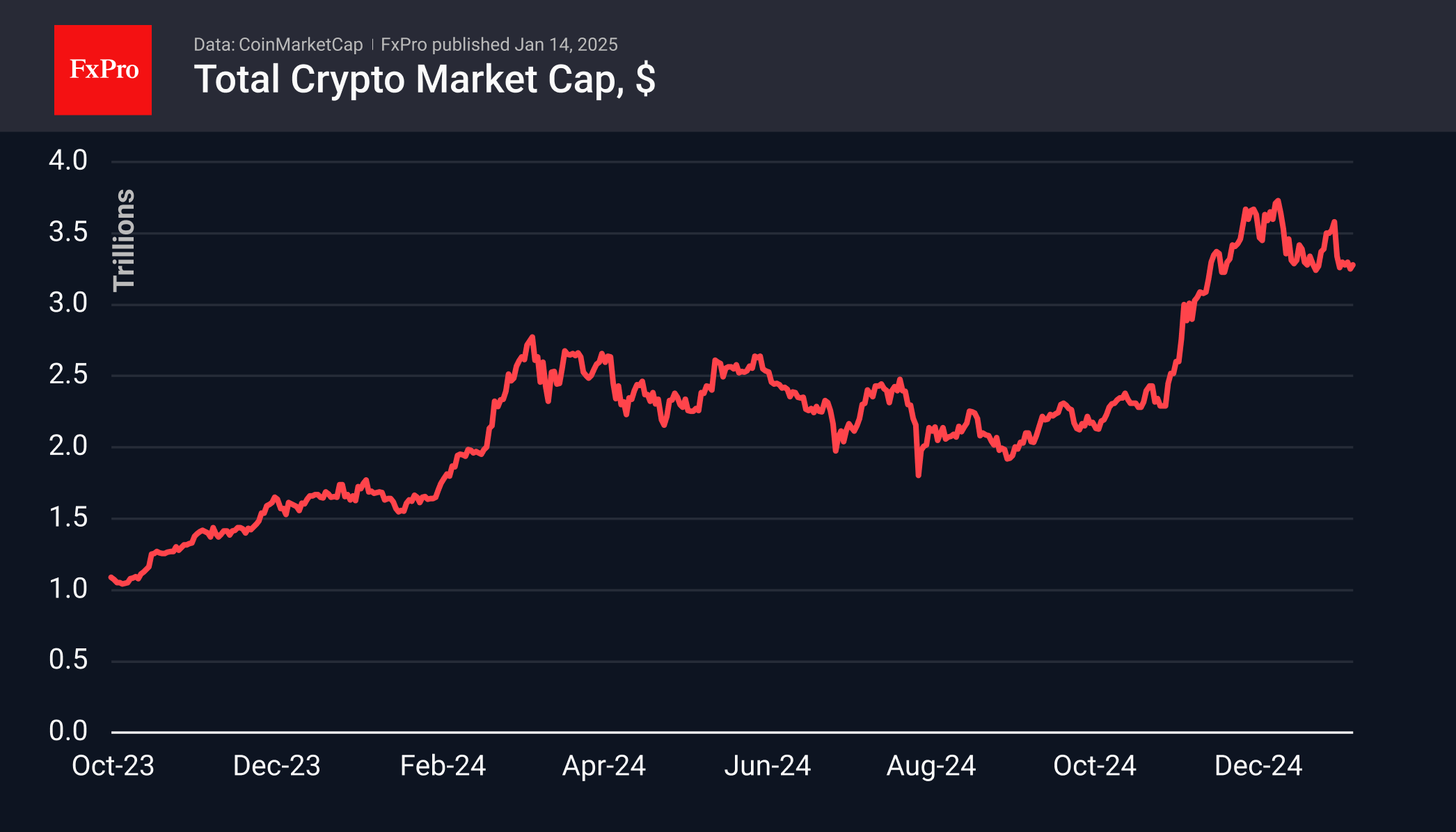

As of Tuesday morning, the cryptocurrency market had increased 2.6% over the past 24 hours to reach $3.31 trillion. The previous evening, its capitalisation was down to $3.14 trillion—its lowest in three and a half weeks.

The Crypto Market Sentiment Index rose 2 points on the day to 63, advancing after Friday’s drop to 50 – exactly midway between fear and greed. The index has been drifting downward since late November, but the drop late last week may well have been the bottom for the market.

Bitcoin briefly slipped to $89,000 on Monday for the first time since 18 November. This was a liquidation of ‘weak’ long positions by the start of active U.S. trading. Stock markets then recovered, and bitcoin reversed to the upside. Aside from a brief slip to the downside, bitcoin generally held within a consolidation, quickly returning to the $94,000 area. On Tuesday morning, the first cryptocurrency’s rise continues, bringing the price to $95,500.

Despite the prolonged correction, this is still a bull market where it is preferable to look for buying dips rather than selling highs.

News Background

According to CoinShares, global crypto fund investments rose by $48 million last week. Overall, changes in inflows over the past three weeks have been small. Bitcoin investments were up $214 million, XRP was up $41 million, Solana was up $15 million, and Ethereum was down $256 million.

Another recalculation saw the first cryptocurrency’s mining difficulty increase by 0.61%, updating the record at 110.45 T. The average hash rate for the period since the previous value change was 804.05 EH/s.

Tether is ‘completing all formalities’ to move to El Salvador after successfully obtaining a digital asset service provider licence as a stablecoin issuer. Tether is currently registered in the British Virgin Islands.

MicroStrategy bought an additional 2,530 BTC for $243 million last week at an average price of $95.972 per coin. The company holds 450,000 BTC on its balance sheet, purchased for a combined $28.2 billion at an average price of $62.691.

According to Bloomberg, the Trump administration is considering candidates for a cryptocurrency advisory board from among the CEOs of key companies in the industry. The council is expected to begin work in late January.

The FxPro Analyst Team