Market Picture

The cryptocurrency market added 2.2% in 24 hours to $2.66 trillion, with heavy buying in “older” altcoins. The Cryptocurrency Fear and Greed Index climbed to 80 – extreme greed – the highest since 27 March.

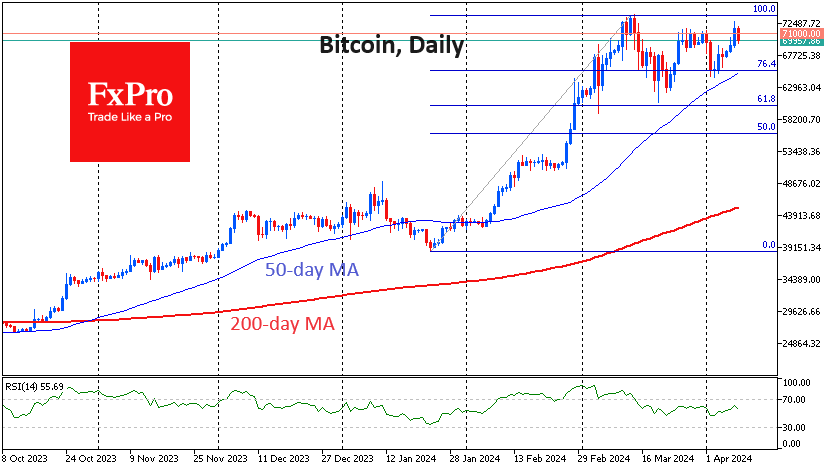

Bitcoin added over 5% during the day on Monday, rising to $72.8K at its peak, about 1k below its all-time high. The ease of gains was another reminder that this is a bull market for cryptocurrencies. The corrective pullback from the March highs gave bitcoin a needed respite, allowing for further upward movement.

Ethereum rallied throughout Monday, adding about 10% and surpassing $3700, its highest since March 15. There has been a pullback since Tuesday morning, but it looks more like an attempt to take profits after six consecutive days of gains than the start of a decline. Technically, the bullish signal in ETHUSD’s rise is a sharp move above the 50-day moving average on Monday. An equally strong downside momentum would be required to reverse the positive scenario.

According to CoinShares, crypto fund investments rose by $646 million last week after inflows of $862 million a week earlier. Bitcoin investments were up $663 million, Solana was up $4 million, Litecoin was up $4.4 million, and Ethereum was down $23 million. Signs of the hype around ETFs are waning. Trading volume last week fell to $17.4bn for the week, down from $43bn in the first week of March, CoinShares noted.

News background

The inflow of funds into spot bitcoin ETFs is likely to continue until the halving, Sentiment expects but does not venture to predict investor behaviour after the event.

Cryptocurrency market capitalisation will double to over $5 trillion in 2024, according to Ripple CEO Brad Garlinghouse. He said he is “very optimistic” about the emergence of spot bitcoin-ETFs in the US, which are “bringing real institutional money to the table for the first time”.

Cardano blockchain co-founder Charles Hoskinson revealed two major updates, one of which is due in 2024. He said the Chang hardfork is scheduled for the second quarter, which will be the largest upgrade since the launch of Vasil in September 2022.

Solana developers are looking for solutions to combat network congestion, but that will take time, Solana Labs co-founder Anatoly Yakovenko said. The blockchain has faced a spate of failed transactions in recent weeks due to the meme-token boom and a significant increase in DEX trading volumes in the ecosystem.

Users have discovered several adverts used to steal cryptocurrencies on the Ethereum Etherscan blockchain browser website.

The FxPro Analyst Team