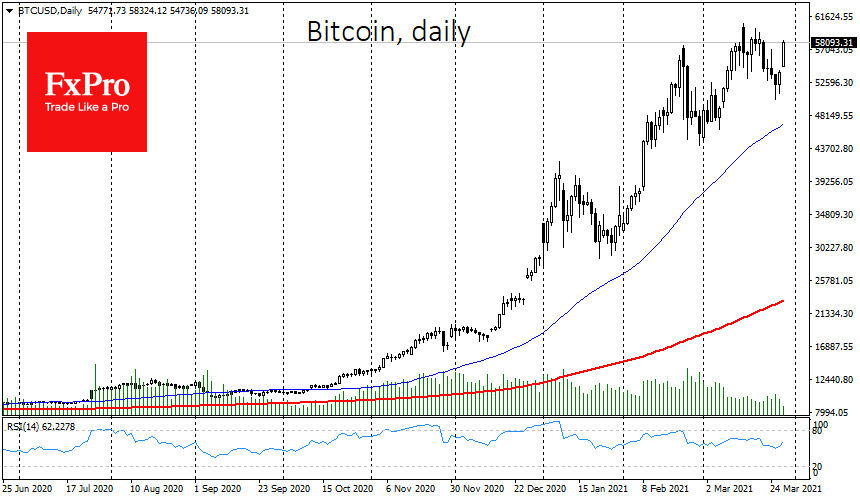

Bitcoin held the $50K threshold, allowing it to rebound to $57K over the weekend. Retail investors took the opportunity to enter the market at a large discount, but it did not lead to a test of $60K. The market also received positive momentum on the news that Visa has added support for USD Coin as part of a pilot program. This is a new sign of acceptance of cryptocurrencies in the traditional financial industry.

Positive price movements coupled with reduced trading volumes could be considered alarming. Since reaching the local low of $51K and as the price rebounds, volumes are down 44%. That is, we are witnessing the right reaction of the market, but we do not see the enthusiasm.

Investors will probably be in standby mode for new triggers in the near future, trying to see if there is enough momentum left in the crypto market for another $60K test.

The Biden administration has said it is working through another stimulus package, which should eventually also keep the growth momentum in the crypto market. The new cash checks for Americans are probably still the biggest positive argument during the tug of war between the bulls and the bears.

The Crypto Fear & Greed Index for Bitcoin and major cryptocurrencies along with the price reached a local low of “54,” after which, in full accordance with the price dynamics, went up, and at the beginning of the working week reached the value of “72,” which corresponds to the “Greed” mode. The index is close to switching to the next stage, indicating an overheated condition.

As originally conceived, cryptocurrencies act as a reserve monetary instrument in emerging economies. The most prominent recent example was Turkey. Saving their money from the depreciation of the lira, Turkish citizens began to buy Bitcoin. As a result, news emerged that the value of the coin in the country had reached $100K.

Along with the desire to save the asset’s value, cryptocurrency users also need decentralized data storage. The relevance of this is shown by the success of the Filecoin project. The coin has gained 60% in a week and is now trading around $129. The primary point of the project is to use surplus HDD space to store users’ data, paying them a fee in the form of a FIL token for providing the space. However, as in the case of Bitcoin, where a significant share of computing power ends up being concentrated in China, the main participants in the Filecoin ecosystem also comes from that region.

The FxPro Analyst Team