Market picture

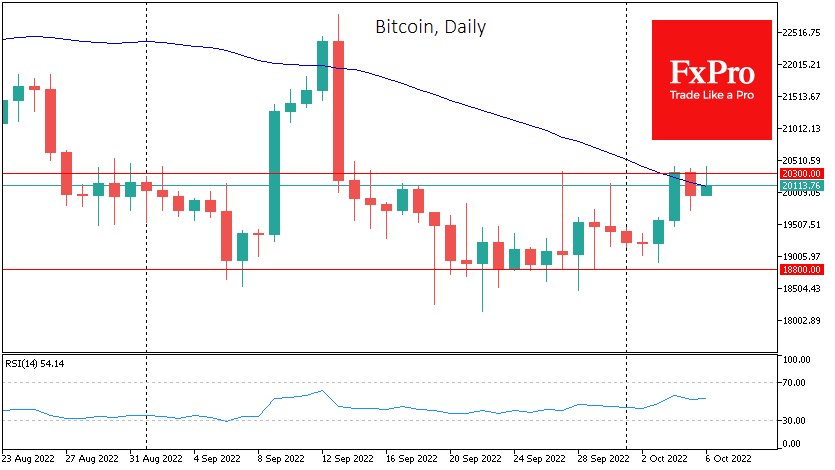

Bitcoin was down 1.7 per cent on Wednesday, ending the day at around $20K amid a retreat in stock indices and a stronger USD. BTC corrected downwards after a two-day rise.

The cryptocurrency Fear and Greed Index was up 1 point to 26 by Thursday and stepped up from “extreme fear” into “fear” status.

The $20.3K mark has been acting as local resistance for over three weeks. On Thursday morning, we continue to see selling pressure at this level. In other markets, it is also easy to see the doubts among the players whether the risk demand has started to recover. Investors and traders are waiting for signals from the Fed or other central banks to start the rally. Either a clear sign that “this time is different” and that the weak economy will not cause regulators to soften.

Those with the glass half-full note that the active phase of price declines has dried up, and we are speculating about when the price will start to rise, but not how deep the plunge will go.

According to CryptoQuant, miners sharply reduced bitcoin sales in September after the August reset, shifting to holding reserves.

News background

Galaxy Digital head Michael Novogratz said that in the current environment, bitcoin could still be a good store of value but was unlikely to exceed $30,000 by the end of the year. According to him, BTC has fallen under the sledgehammer of the Fed’s fight against inflation, and only a softening of this policy could cause the market to grow.

The international payments system SWIFT has reported a successful test of a full-scale Central Bank Digital Currency Deployment (CBDC).

According to Chainalysis, the Middle East and North Africa (MENA) region has led the way over the past year in adopting cryptocurrencies in various areas of life. Latin America and North America follow with 40% and 36% respectively.

In the third quarter, the crypto industry lost $428 million from hacks and scams, experts at bounty platform Immunefi calculated. There were 39 incidents, of which 30 were actual hacking attacks with a total loss of $399m.

The FxPro Analyst Team