Bitcoin has been hovering around the 30K mark for a second day, forcing the rest of the crypto market to balance declines and gains. Ethereum has lost 1.2% in 24 hours but remains near 2,000. Altcoins from the top ten are mostly declining, losing between 0.7% (DogeCoin) and 3.8% (Polkadot). Tron is gaining 1.7% but has been little changed since the end of last week.

Total crypto market capitalisation, according to CoinMarketCap, declined 1.1% overnight to $1.29 trillion. Bitcoin’s dominance index remained unchanged at 44.3%.

The Cryptocurrency Fear and Greed Index was up 4 points to 12 by Wednesday and remains in “extreme fear”. The index’s recovery from lows since 2019 is due to a waning selloff but not a market reversal to growth.

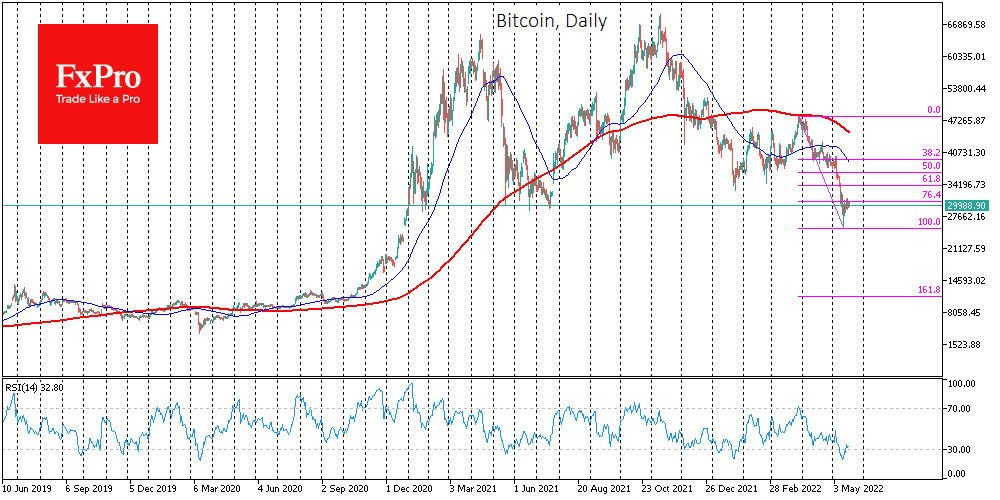

Bitcoin has stalled at the psychologically significant 30K level and has also lost the momentum of the rebound at the 76.4% Fibonacci line from the downward move from late March to last Thursday’s lows. This is a typical shallow counter-trend correction.

The inability of the market to develop the offensive from the current levels would raise the question that the final target for the downtrend would be the 161.8% area of that move, which is near $11.3K. Such a setback would cancel out all upside momentum from October 2020. So far, this scenario looks exceptionally pessimistic and needs to converge the disappointment of crypto neophytes on top of an actual collapse of the global economy and stock market.

Such a dip would leave Bitcoin’s price at only 16% of its peak, which has happened several times in its history. However, a significant drop below previous cyclical highs ($20K) would be unusual, although Bitcoin was previously repurchased on similar drawdowns.

Perhaps a more cautious scenario would be a dip into the $20-23K area to close the gap at the end of 2020 or a return to the 2017 highs.

The realist-optimistic scenario points to the possibility of cautious buying by long-term investors from current levels. However, it does not suggest a new wave of explosive growth, as financial conditions, and a return to the area at the start of 2021 are disappointing for those investors who have been buying cryptocurrencies to make a quick buck. Moreover, inflation has weaned 10% off the dollar’s purchasing power over this period.

Among the news that caught our eye were:

According to CoinShares, institutional investors invested $274 million in crypto funds last week, a record since the start of the year.

Following TerraUSD, another stable coin – DEI – lost its peg to the US dollar. According to the Congressional Research Service (CRS), the stable coin market needs strict regulation.

Because of the speculative nature of cryptocurrencies, investors need more protection, or they could lose confidence in the markets, SEC chief Gary Gensler said.

The Portuguese authorities are considering introducing a tax on income earned from investments in digital assets.

Dogecoin co-founder Billy Marcus called 95% of crypto assets “trash” and suggested that 70% of investors don’t even understand the fundamentals of the crypto market.

The FxPro Analyst Team