Market picture

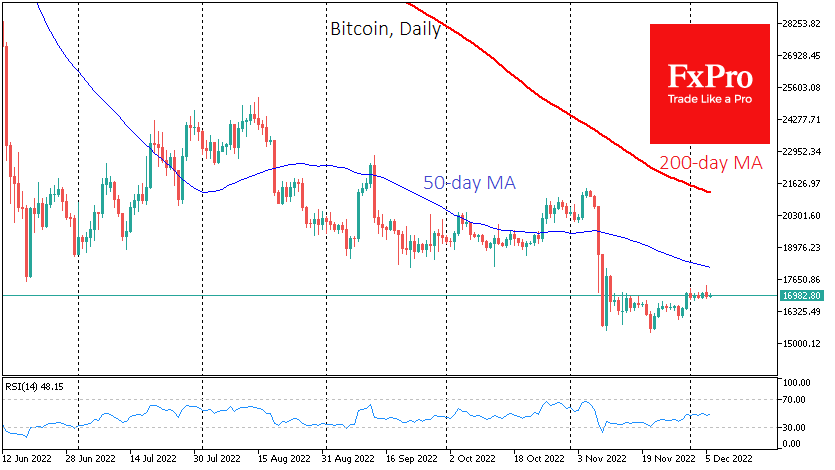

Bitcoin once again failed to get on the upside track, and its exchange rate fell to $17K, around which it has been languishing since the beginning of the month. The reason for the decline was pressure in the markets due to relatively good economic data, which increased speculation that the Fed would have to go further in raising rates than previously expected.

We note that the crypto market recently had very subdued volatility compared to stocks, having missed much of the rally of the last two months but also not feeling the kind of pressure that stocks have been under since early December.

The cryptocurrency fear and greed index down 1 point by Tuesday, to 25, and had moved into “extreme fear” status. The total capitalisation of the crypto market fell 1.9% to $853bn.

The suppressed volatility in the cryptocurrency market is causing market participants to move stop orders closer to the current price. A drop below $16K (-6%) could devastate speculators’ positions, delaying a potential market recovery for many more months. On the other hand, a rise above $18K (+6%) could open a direct track to $21K.

With professional market makers becoming less active towards the end of the year, it will become increasingly easy to swing the price in either direction (or even in both directions).

News background

According to CoinShares, investments in crypto funds fell by $11m last week after an outflow of $23m the week before. Bitcoin investments rose by $11m, and Ethereum fell by $4m. Investments in funds that allow shorts on bitcoin fell by $11m. Trading volume was $753m, compared to an average of $2bn a year ago, suggesting low investor engagement, CoinShares noted.

Cryptocurrency broker Genesis Global Capital has reached $1.8bn in debt and is likely to continue to grow, CoinDesk reported. Messari estimates that the platform needs to raise at least $500m to avoid liquidation.

Bloomberg Intelligence senior commodities strategist Mike McGlone believes that cryptocurrencies are now going through their last phase before hitting rock bottom. However, he says it will be tough for investors and companies to survive this phase.

A Chinese court has ruled that non-exchangeable tokens (NFTs) are virtual property that should be protected by law.

The FxPro Analyst Team