Bitcoin was down 7.4% on Monday, ending at around $39.9K and remains here on Tuesday morning. Ethereum lost 8.9%, while other leading altcoins in the top 10 fell in price from 6.7% (Binance Coin) to 13% (Terra).

Over the past 24 hours, cryptocurrency market capitalisation, according to CoinMarketCap, has fallen 5.2% overnight to $1.85 trillion, with the Bitcoin Dominance Index dropping 0.2 points to 41.1%.

The cryptocurrency fear and greed index lost 12 points to 20 by Tuesday, in a state of “extreme fear”.

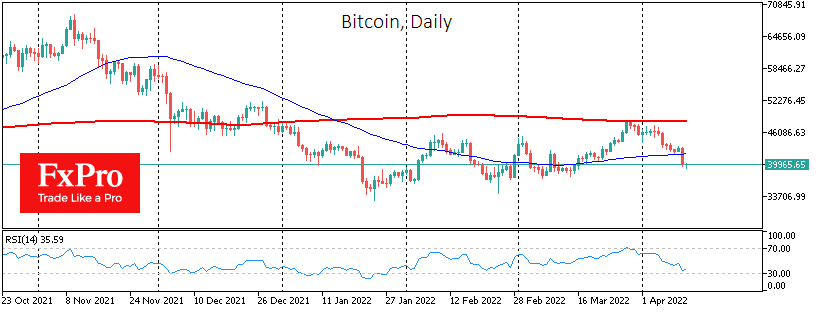

Bitcoin collapsed on Monday, the most in almost two months, following global stock indices. In a sharp move, BTC plummeted under the 50-day moving average, dashing hopes that we saw a trend breakdown in March.

Yesterday’s drop in bitcoin and the continued pessimistic mood in financial markets open a direct and quick path to the March support area – near $38K, or even lower – to $32.5-35K.

Conventional financial market participants have just started laying down the accelerated pace of rate hikes, expecting +50 points in May and the same amount in June. This is in stark contrast to the 25 point rises per quarter that we have seen since the global financial crisis. In this environment, liquidity leaves the financial markets, hitting the highest risk sectors the hardest. Because of this, we see a steep drop in cryptocurrency capitalisation and the Nasdaq index.

According to CryptoQuant, miners dumped some bitcoins last week as the cryptocurrency declined. Bearish sentiment may dominate this week as the BTC exchange balance has risen again.

The cryptocurrency market is threatened by a decline in US stock indices soon, according to BitMEX cryptocurrency exchange co-founder Arthur Hayes. Bitcoin could fall to $30,000 by the second quarter, Ethereum to $2,500.

David Rubenstein, the co-founder of The Carlyle Group, believes that cryptocurrencies will increase amid growth in the crypto industry and political instability.

According to a Nasdaq survey, 72% of financial advisers would invest client funds in cryptocurrencies if they had access to spot crypto-ETFs.

The FxPro Analyst Team