Bitcoin gained 6.3% over the past week, finishing near $41.3K. The price retreated slightly to $41.0K on Monday morning, losing 2.1% over the last 24 hours. Ethereum has corrected by 2% over the same period but still added 11.6% to the price seven days ago. Other leading altcoins in the top 10 have gained between 7.3% (Polkadot) and 24.8% (Avalanche) over the past week.

Total cryptocurrency market capitalisation, according to CoinMarketCap, rose 7.5% for the week to $1.86 trillion. The Bitcoin Dominance Index fell 0.6 points to 41.9% due to outperforming altcoins.

The Cryptocurrency Fear and Greed Index rose 7 points for the week to 30 and moved into “fear” from “extreme fear”.

Last week turned out to be a good one for the crypto market, with bitcoin rising the most in six weeks. Last Wednesday, the US Federal Reserve meeting weakened the dollar and boosted stocks, which benefited all risky assets, including cryptocurrencies.

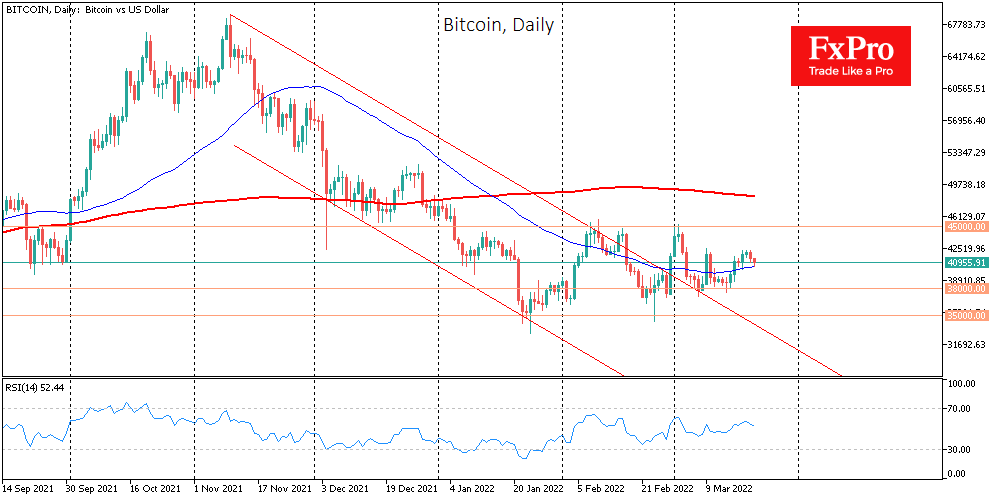

Meanwhile, bitcoin has continued to trade in a sideways range of $38-45K for the second month, with a closer look marked by a sequence of declining local highs with bullish momentum fading near 42 in the last two weeks. The positive sentiment is supported by the 50-day moving average reversing upwards. BTCUSD broke it in a relatively strong move on March 16th, and it has been acting as local support ever since.

The external environment in the financial markets remains mixed. Traders have tighter financial conditions due to higher rates and waning economic growth on one side of the scale. On the other side is the demand for purchasing power insurance for capital due to the highest inflation in two generations. Weighing these factors, Galaxy Digital head Mike Novogratz said bitcoin would continue to trade in a sideways range this year. He said BTC will resume growth and reach $500K by 2025 as inflation curbing measures are too weak.

Piyush Gupta, chief executive of Singapore’s largest bank, DBS, said cryptocurrencies could be an alternative to gold but would not be able to fit into the traditional financial system due to excessive volatility.

The FxPro Analyst Team