Market picture

The crypto market capitalisation is down 3.2% for the week to $1.09 trillion. However, this is more of a high base effect due to a solid start to October, which quickly deflated.

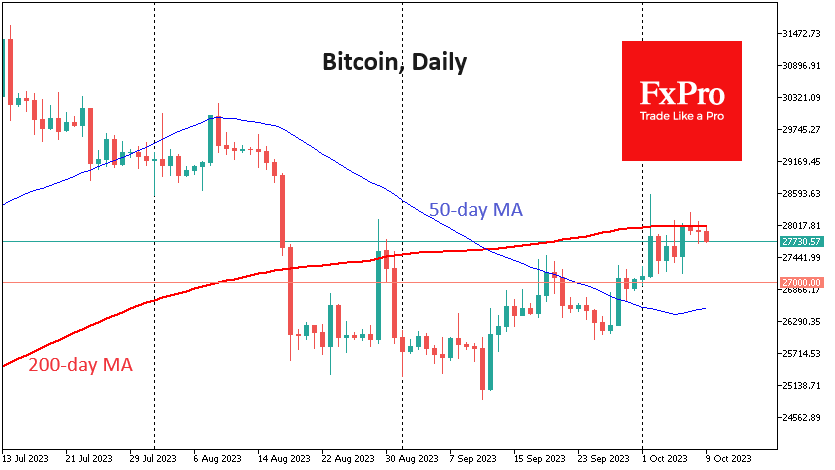

Technically, bitcoin remains in an uptrend but ran into resistance at its 200-day moving average over the weekend. Having lost its ability to rally, bitcoin has returned to the general crypto market, where the major altcoins remained under pressure for most of last week. All eyes will be on BTCUSD to see if it can successfully consolidate above $28,000, the 200-day moving average. If it does, we can expect a quick rise to $29.0K-$29.3K.

If the pressure on risk assets, including the first cryptocurrency, remains, all eyes will be on the $ 27.2K-27.0K area. Without significant support here, we could be talking about a change from a short-term trend to a downtrend.

Ethereum is creeping lower, leaving the 50-day moving average as resistance. This is a bearish signal. In case the markets develop a decline, it is worth paying attention to the dynamics of the second largest cryptocurrency near $1580. A failure to hold here will open the way for a rapid decline.

News background

According to Bloomberg, the total market capitalisation of the stablecoin market fell to $123.8 billion at the end of September, the worst since 2021.

JPMorgan said Ethereum’s centralisation has increased due to the recent surge in interest in staking. The rise in validators has also resulted in lower returns for staking, while those for traditional financial assets have risen.

Binance exchange’s share of total spot trading volume fell to 34.3 per cent in September. The figure fell for the seventh consecutive month. The decline was fuelled by the termination of the stock with zero trading fees for popular pairs, coupled with concerns over regulatory scrutiny.

The US government is waging a war against the crypto industry and trying to take control of Bitcoin, said OpenAI head and Worldcoin co-founder Sam Altman.

US election race participant Robert Francis Kennedy Jr. announced his intention to protect the first cryptocurrency if elected president. He says, “freedom of transaction is as important as freedom of speech.”

Arthur Hayes, the former CEO of crypto exchange BitMEX, said that by 2026, the price of the first cryptocurrency will reach $750K to $1 million. He justified his forecast with the limited issuance of the asset, the prospect of approval of spot bitcoin-ETFs and geopolitical uncertainty.

The FxPro Analyst Team