While the global financial market is pushing upwards, defying the laws of logic and gravity, the crypto market is trapped in a sideways trend. Bitcoin is stuck at around $9K, although it shows some growth at the beginning of the working week and is changing hands at around $9,200. At the same time, trading volume remains low.

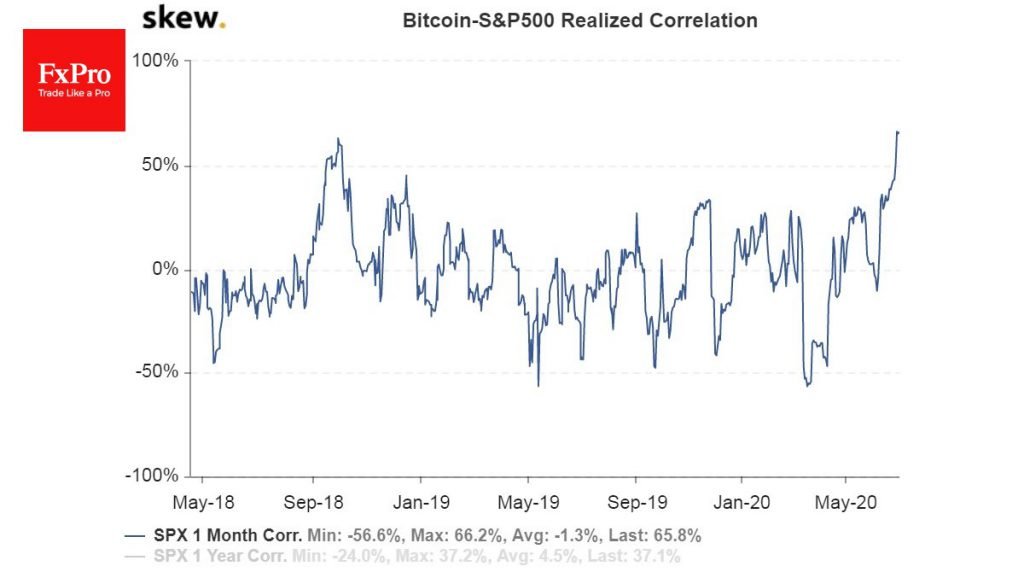

Analytical portal Skew found that the current correlation between Bitcoin and S&P 500 exceeds 65%. This is a signal that Bitcoin is not the polar opposite of the traditional finance market as it was previously believed to be, and is instead moving in the same direction with it.

The current stock market growth causes us to reflect upon the times before the Great Recession when the bubble burst very suddenly. It can be quite difficult for the crypto market to return to growth at a time when retail investors are losing interest in cryptocurrencies as the labour market situation deteriorates. While institutional investors are able to generate growth momentum, they consider Bitcoin to be only a small part of their portfolio.

Miners are still trying to ignore the drop in revenues after halving and adhere to the strategy of fighting for market share. Coindesk concluded that the miners’ revenue in June declined by 26% compared to the previous month.

The computing power of the bitcoin network is very high, but judging by the low transfer fees for hundreds of millions of dollars in transactions, demand is low at the moment. Bitcoin consumes a huge amount of resources but runs virtually without any result, which cannot last or a long time.

Since the beginning of 2020, the crypto market total capitalization has grown by 38%. The stock market is fed by a massive injection of money from central banks. However, the crypto market has no basis to survive the storm if this continues to happen in the near future. Moreover, at the moment, there are no safe havens left in the world for investors. At best, one has to choose from the least vulnerable areas. If Bitcoin needs huge energy resources to operate and faces low demand for its primary function, is unlikely to be the preferred destination for investment.

The FxPro Analyst Team