Market picture

The crypto market continues to climb, rising 3.4% in the last 24 hours to $1.38 trillion. Bitcoin was again the driver, adding 3.8%. Altcoins are moving slower but up, adding between 1.7% (BNB) and 7.7% (Polygon).

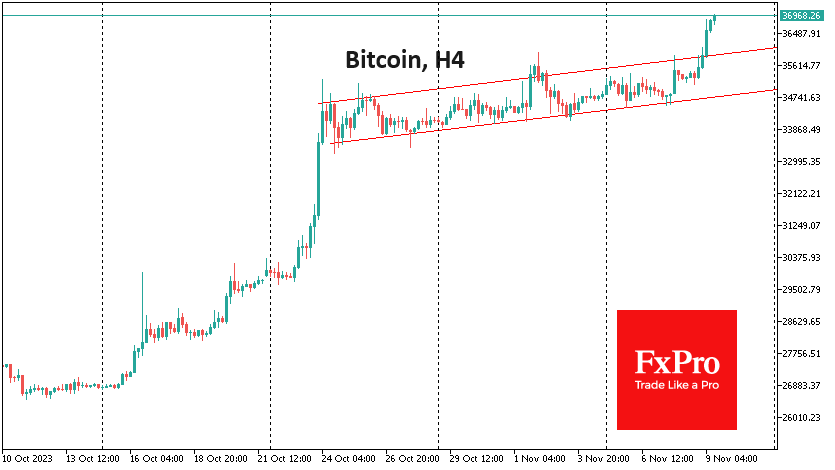

Bitcoin has broken out of a long consolidation range and is approaching the next round level of $37K. The technical implementation of this pattern suggests a rise to $41-45K, depending on which point we choose as the start of the last impulse. The upper limit looks like a suitable target with a pivot point close to it. Near it, in April 2022, the corrective rebound ended, and the most relentless phase of the sell-off began.

Despite Bitcoin’s strong recovery since the beginning of the year, the supply of coins is extremely limited due to the actions of hoarders. Many metrics that characterise “bitcoin inactivity” have reached historic highs, Glassnode noted.

News background

The significant increase in Open Interest in bitcoin futures creates conditions for the price of digital gold to continue rising, according to YouTube analyst CredibleCrypto.

The European Banking Authority has launched a public consultation on capital and liquidity requirements for issuers of stablecoins and other digital tokens.

According to Bloomberg, USDC stablecoin issuer Circle Internet Financial is considering an IPO in early 2024.

Swiss cryptocurrency bank SEBA received a licence from the Hong Kong Securities and Futures Commission, allowing it to provide digital asset-related services to residents.

Exchange Binance announced the launch of Web3 Wallet, available to users via the platform’s mobile app. The utility uses Multi-Party Computing technology, which splits private keys into three parts and stores them on different servers.

The FxPro Analyst Team