Market picture

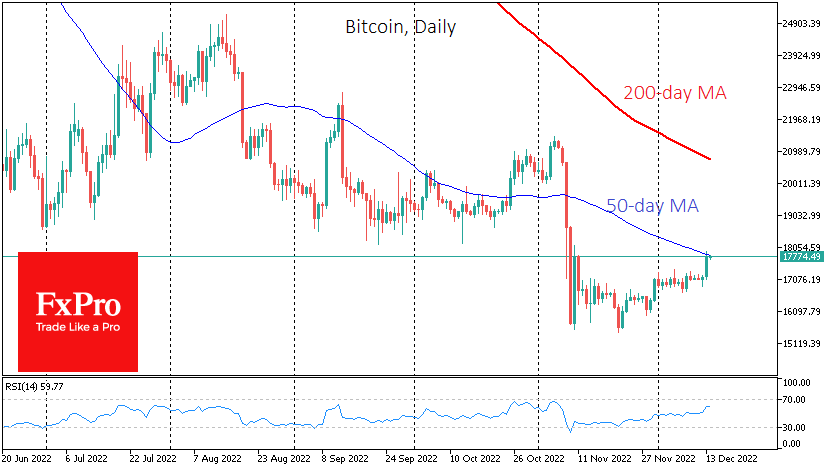

Bitcoin was adding 5% intraday on Tuesday, at one point approaching $18K. The primary growth momentum co-occurred as the stock market after US inflation data boosted risk appetite.

The price increased a few hours before the release amid an active European session. Perhaps Bitcoin’s buying was facilitated by problems with USDT withdrawals from Binance, which prompted the search for liquid alternatives to Stablecoin.

In addition, the first cryptocurrency is trading just 0.8% below yesterday’s peak, against a 3% decline in the Nasdaq100, which returned to its pre-release starting point three hours later. The risk hangs over the markets that the Fed might indicate in the evening that it does not share investor optimism on inflation.

Short-term, positive development and consolidation above $18K promise to be a strong bullish signal, opening a quick path to $20.8K.

News background

Popular YouTube crypto analyst Tone Vays expects bitcoin to rally before the end of the year, at least to $20,000, where selling could pick up. He says BTC fumbled for a bottom in November at around $15,500 and broke the upward sideways range.

According to a JPMorgan study, the proportion of US adults who have ever transferred funds into a cryptocurrency-linked account has risen from 3% before 2020 to 13% as of June 2022.

According to Coinglass, bitcoin outflows from the Binance exchange intensified over the past week, with 40,150 BTC being withdrawn. The mass withdrawal of the cryptocurrency began after it was reported that the US Department of Justice was investigating money laundering through the trading platform.

The G20’s International Financial Stability Board (FSB) will present proposals to regulate the cryptocurrency market in early 2023, with a specific timetable for implementation. The catalyst for the initiative was the collapse of FTX.

The FxPro Analyst Team