Market picture

The crypto market lost 0.5% in 24 hours, bouncing back to $1.18 trillion. This level has become the centre of gravity around which the market has been moving all week. So far, it looks like a pause and consolidation but not a breakout.

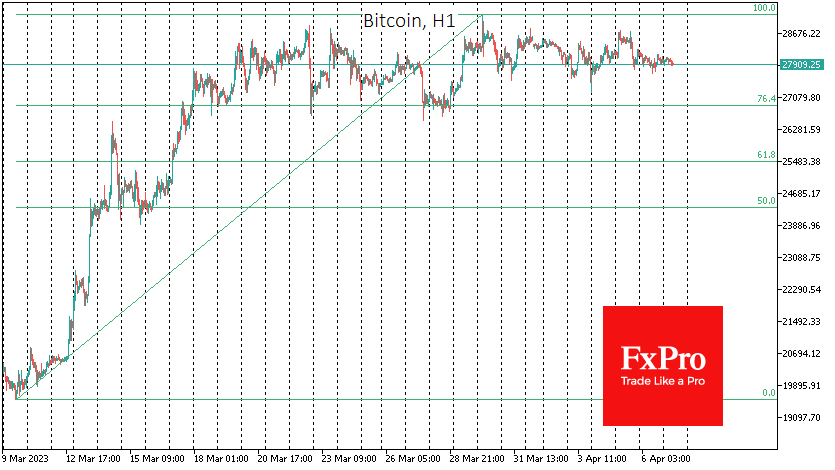

Bitcoin has fared better this time around, losing 0.4% and remaining stuck at $28K for the past three weeks. Notably, there has been no deep correction or noticeable upward bias during this time. Bitcoin’s rally has stalled in the area that provided meaningful support in May and early June last year. An upside move would be a significant milestone to restore long-term investor confidence.

On the other hand, a deeper drawdown below $27.0K or even to $25.5K may be required before a move higher, which would fully correct the rise from the early March lows and clear the way to the upside.

News background

According to CCData, trading volumes on centralised crypto exchanges reached $3.81 trillion in March, the highest since September 2022. Trading volumes on the cash market rose 10.8% to $1.04 trillion, while the derivatives market jumped 32.6% to $2.77 trillion.

Cryptocurrencies will reduce transaction costs for remittances by 97%, according to a study by Coinbase. Americans sending money overseas collectively pay more than $12 billion in fees each year.

The market capitalisation of the Tether stablecoin has surpassed $80 billion, rising by $15 billion in the first three months of 2023 to a record high since May 2022.

The FxPro Analyst Team