Market Picture

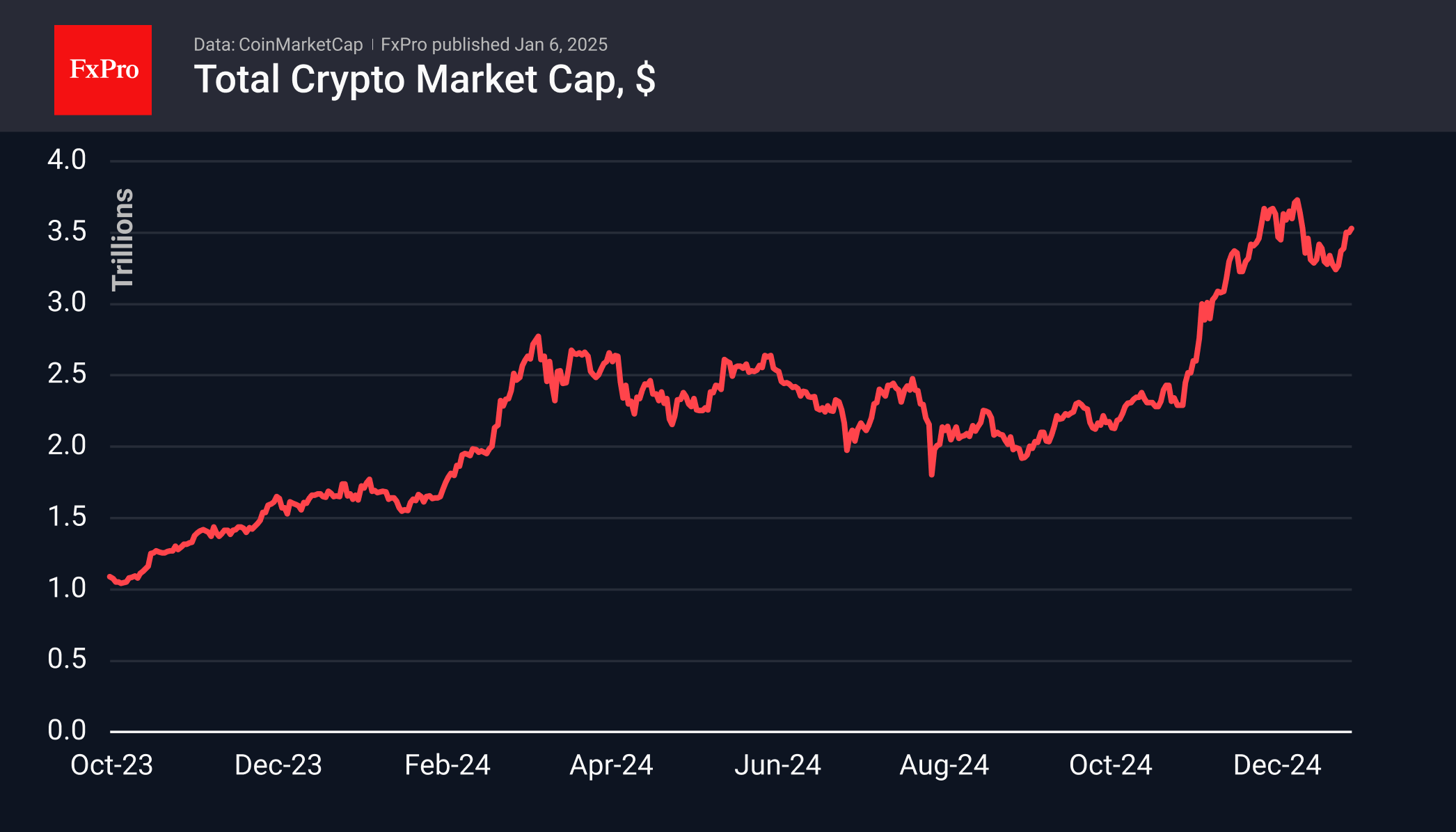

The crypto market capitalisation has surpassed $3.5 trillion, the highest since 19 December. Short-term growth in the market is being replaced by periods of consolidation. The market seems to be probing the ground beneath its feet and moving gently upwards. The sentiment index of 76 (extreme greed) indicates a period of active buying, leaving plenty of room for growth.

Bitcoin rose for the seventh day in a row and has already passed the $99,000 mark, a level it has traded above for less than two weeks.

So far, the technical picture looks like a classic correction completion with a resumption of the growth of 61.8% of the rally since the beginning of November. This scenario will be confirmed if the historical highs of around $109,000 are confidently breached. At the same time, we expect Bitcoin’s growth to accelerate after the $100,000 mark.

News Background

According to SoSoValue, net inflows into spot Bitcoin ETFs in the US were $908.1 million on Friday, 3 January, with net inflows of $245 million for the week after outflows of $387.5 million earlier. Spot Ethereum-ETFs saw net outflows of $38.2 million for the week, breaking a 5-week positive trend.

MicroStrategy is looking to raise an additional $2bn by selling shares to buy more of the first cryptocurrency. The final decision on the expansion of the BTC investment programme will be made at the shareholder meeting in the first quarter of 2025.

JPMorgan said the share of gold and Bitcoin in investors’ portfolios is expanding. In the long term, the strategy of capital protection against inflation and depreciation of fiat currencies will remain.

Solana developers have created quantum-resistant storage on the blockchain. Solana Winternitz Vault is available as an optional solution and is not yet applicable to the entire blockchain.

Chinese authorities will extend Forex rules to crypto transactions. China’s State Administration of Foreign Exchange (SAFE) has listed cryptocurrency transactions as risky transactions and requires financial organisations to monitor all transactions.

Bitcoin has turned 16 years old. The anonymous creator of Bitcoin, Satoshi Nakamoto, launched the network for the first cryptocurrency on 3 January 2009. At that time, the first block in the BTC network, the so-called genesis block, was created. On 9 February 2011, Bitcoin equalled the value of the US dollar for the first time.

The FxPro Analyst Team