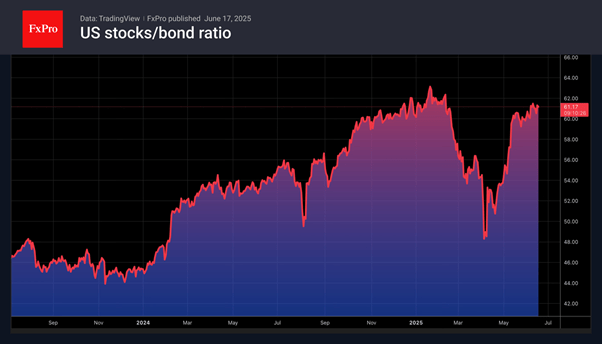

Bitcoin has failed to capitalise on the latest rise in risk appetite in financial markets. The ratio of US stocks to US Treasury bonds has reached its highest level since Donald Trump’s inauguration. The S&P 500 rose on reports that Iran is seeking ways to resume nuclear talks with the United States. Investors believe that the worst of the conflict in the Middle East is behind us and will end soon.

The crypto market leader seems to be stuck between two worlds. It is not responding to the increase in global risk appetite, but it is not growing like safe-haven assets against the backdrop of escalating geopolitical tensions. Bitcoin and gold have a lot in common: their supply is limited in nature, and they cannot be destroyed. Tokens are easier to transfer or hide than precious metals. As a result, digital assets are sometimes used as a safe haven, especially in cases where confidence in fiat currencies is undermined.

It is the weakness of the US dollar in 2025 that is one of the key drivers of the 13% rally in Bitcoin since the beginning of the year. If the USD index continues to fall due to the White House’s tariff policy, Bitcoin will grow.

Meanwhile, Michael Saylor’s Strategy continues to buy up Bitcoin. Another $1 billion has been invested in the cryptocurrency, increasing its reserves to $63.4 billion. Specialised exchange-traded funds are not far behind. The largest ETF, iShares Bitcoin Trust, attracted $12.5 billion in 2025, increasing its reserves to $70 billion. Growing demand from institutional investors is supporting Bitcoin.

Perhaps the markets are overly optimistic about the armed conflict in the Middle East. Israel intends to fight to the bitter end, and the United States is not asking it to stop. As the conflict drags on, global risk appetite will decline, which will be bad news for both US stock indices and Bitcoin. On the contrary, the sooner the mutual attacks between Tehran and Jerusalem come to an end, the higher the chances of a recovery in the coin’s upward trend.

The FxPro Analyst Team