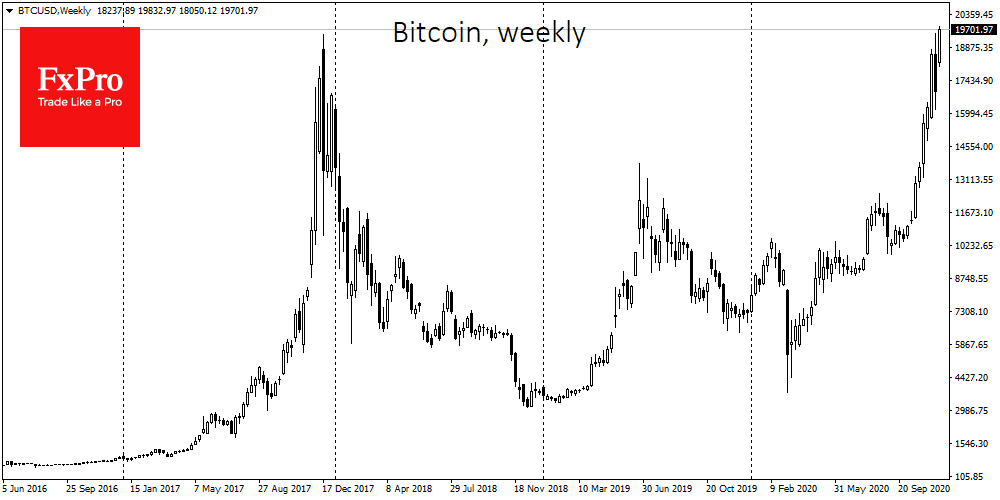

Bitcoin fully offset the recent wave of decline, showing a 5% increase over the last 7 days. If we take current price dynamic, the first cryptocurrency has grown by 7% and changes hands for $19,500. The coin has quickly overcome the round level, and the historical maximum has reappeared on the horizon.

However, it is worth remembering again about the technical indicators, which are in the overbought condition. The Crypto Fear & Greed Index for Bitcoin and the largest cryptocurrencies stuck in “extreme greed” mode since November 6. The recent BTC sell-off has not been able to “cool down” the indicator. Thus, there may be a sell-off ahead, especially if Bitcoin reaches a historic high in a short time.

However, will the correction, which is likely to push Bitcoin down to $14K, be so terrible? As we have seen after the March slump, and continue to see over and over again after the pullbacks, the demand for Bitcoin is quite strong. If the BTC goes down and confirms that past resistance levels have become confident levels of support, the market will get a dose of medicine. Technical indicators will reset and the market will squeeze out the least optimistic investors.

Confirming its ability to quickly recover, the leading altcoin Ethereum (ETH) has once again surpassed $600. The coin barely crossed the threshold last week when the sell-off began. The coin declined below $500, but immediately after it showed a significant increase in demand, which indicated the desire of investors to open positions at a discount. However, an even more positive effect can be seen in the fact that investors consider the levels around $500 as a good entry point and believe in further growth. It is worth remembering that in early 2020 Ethereum (ETH) was traded for $130.

The XRP felt much better than other coins. The token shows 23% growth for the week. During the day token showed growth by 5% and traded for 65 cents. Fast and cheap money transfers project in an epidemic world with closed borders is the right direction for investment. This is probably the reason why investors are pushing up the value of XRP.

This festive season could be the strangest one in history. People are limited in their social life, but they have not run out of money yet. It is likely that in addition to the goods and services needed in isolation, at the end of 2020, demand will also grow for digital currencies, which are once again in the spotlight and may become one of the main investment phenomena of the coming year.

The FxPro Analyst Team