Market picture

The crypto market added 1.3% in 24 hours to $2.58 trillion. This is roughly the area where trading has been centred for the last week, despite attempts by speculators to rock the market. Volatility in the market has decreased, with prices of the major coins varying between -1.3% (Toncoin) and 3.3% (Solana), while Shiba Inu shot straight up 15% to its highest since early April.

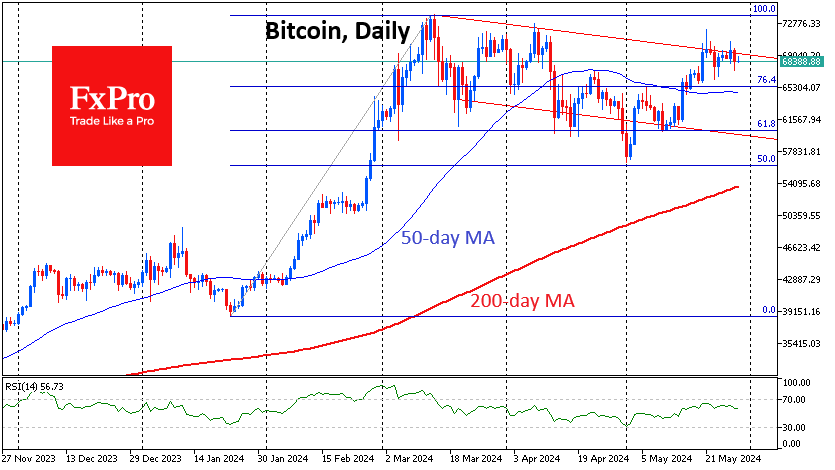

Bitcoin continues to hover near the upper edge of the descending range, building up strength before the next move. All we have to do is reiterate that an exit above $70K will break this bearish pattern. Until then, the classic development is a pullback to the lower boundary, but we see this as an alternative option, suggesting a further breakout after consolidation.

According to CoinShares, net inflows into crypto funds totalled $1.05bn last week, up from $932m a week earlier. Bitcoin investments were up $1.01bn, Ethereum was up $36m, and Solana was up $8m.

News background

Cumulative ETF investments since the beginning of the year rose to a record $14.9 billion. The total AuM of crypto funds reached $98.5 billion. Weekly trading volumes rose 28% to $13.6 billion. CoinShares noted that sentiment is becoming generally positive, which is likely due to investors interpreting the FOMC minutes and recent macroeconomic data as slightly dovish.

MicroStrategy founder Michael Saylor pointed out that 32 cryptocurrency ETFs have accumulated more than 1 million BTC (~$70bn)—or about 5% of all asset issuance. According to SoSoValue, the largest ETF is still Grayscale’s GBTC, with $20bn in assets under management (AUM), almost caught up by its closest competitor, BlackRock’s IBIT.

Medical technology specialist Semler Scientific announced the purchase of 581 BTCs worth $40 million. According to the company, BTCs are now “the Treasury’s primary reserve asset” because they are “a reliable store of value and an attractive investment.” Semler Scientific shares jumped 28%.

George Soros’ fund invested $159 million (2% of assets) in the first quarter in shares of MicroStrategy, a company that accumulates bitcoins.

QCP Capital notes that market participants are expressing optimism about Ethereum, as indicated by the growth of open interest in call options on the digital asset.

CryptoQuant notes that indicators show the Bitcoin rally is not over yet. Low unrealised profits of BTC investors exclude strong selling.

The FxPro Analyst Team