Market picture

Crypto market capitalisation rose by 0.5% on the day, approaching 1.2 trillion. The trend of capitalisation growth has been in place since the beginning of the week. Although the bulls’ attempt to accelerate has failed to gain traction, the market is approaching these local highs again as of early Wednesday afternoon.

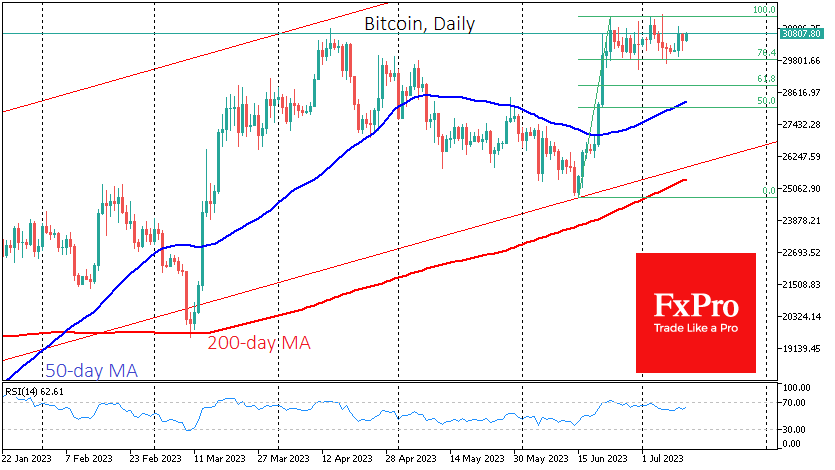

Bitcoin is up 0.6% at $30.8K and is approaching the upper boundary of its short-term range at $31.4K. Only a break above this level will indicate that the market is ready for further gains, with potential targets near $35.5K by the end of the month.

Bitcoin’s capitalisation is 50% of the total market and has been trending higher since the end of last year, coinciding with the turnaround in global equity indices. At the same time, it remains in a long-term downtrend, thanks to increasing competition from altcoins. However, increasing regulatory pressure poses a more significant threat to the latter.

The market is experiencing a period of “reaccumulation”, which often occurs when halving is imminent, Glassnode notes. Previous such periods have resulted in several months of sideways trading. The Network Value to Transactions Ratio (NVT Ratio) indicator, based on 28 DMAs, suggests a “fair value” for Bitcoin of $35,900, above current prices for the first time since November 2022.

Spot trading volumes on centralised exchanges increased by 10.4% in June, while cryptocurrency futures trading volumes rose by 9.5%.

News background

According to K33 Research, employment in the cryptocurrency sector fell by 10% last year, from 210,000 to 190,000. The industry has around 10,000 companies with a total value of about $180 billion.

Bank of England Governor Andrew Bailey said that Bitcoin and other cryptocurrencies do not meet the standards of money. He said they are better classified as “highly speculative investments”.

The UK’s Financial Conduct Authority (FCA) has shut down 26 crypto ATMs in various cities nationwide for illegally offering cryptocurrencies. The regulator also warned consumers of these services that they could lose their money.

After the BRICS countries launch a gold-backed cryptocurrency in August, the US dollar will “die”, and bitcoin will rise to $120,000 in 2024, warned Robert Kiyosaki. He once again urged people to buy gold, silver, and bitcoin.

The FxPro Analyst Team