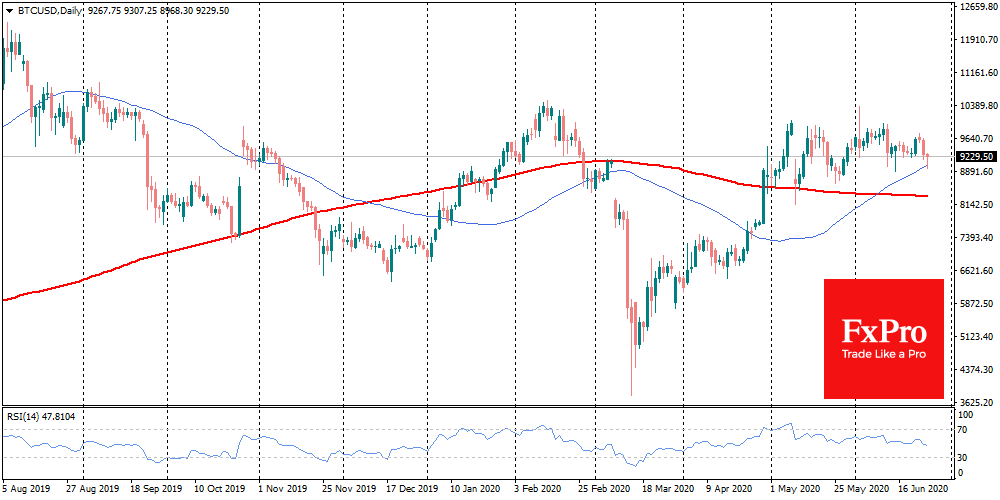

The crypto market has plunged into a painful sale. Over the day, the total capitalization fell by $ 14 billion. The reference cryptocurrency loses almost 5% and changes hands at the level of $ 9,200. The good news is that bears and profit-taking investors were not able to break the round level of $ 9000. However, the price has dropped from a recent trading range. Now the market is in a rather dangerous segment when an increase in negative sentiment can provoke an increase in pressure and push BTC below this round level.

From the technical analysis side, a crucial signal line in the form of a 50-day moving average passes through the $9000. It repeatedly acted as a reliable indicator of the trend. A drop below can put pressure on the quotes of the first cryptocurrency in the following days and even months.

Altcoins followed BTC, and Ethereum (ETH), which has lost almost 6% over the past day, has shown the most significant decrease. However, if the momentum of the sale runs out near current levels, investors will have an opportunity to buy at a lower price.

The general downtrend of the cryptocurrency market again coincides with the dynamics of stock exchanges. Leading stock indices show a decline, and traders will likely recall correlation with stock prices. However, Gold Bullion International co-founder Dan Tapeiro believes that part of the 3-month cash buffer has accumulated, by about $ 4.6 trillion, and can direct capital flow towards Bitcoin.

Of the positive factors, we can note the news that the ATM provider LibertyX launches a campaign with the goal to distribute bitcoin. In more than 20,000 popular stores, it will be possible to buy a reference cryptocurrency worth up to $ 500 directly at the box office. It is unlikely that this will cause significant retail interest. However, such solutions can provide the basis for future growth in case of increased attention to cryptocurrencies in the mainstream.

The jump in new coronavirus cases is growing in many countries, including the US. In this regard, the demand for commodities is falling; investors’ expectations are declining. Fears of the second wave of the epidemic negatively affect cryptocurrencies. They are now on the list of risk-related assets as investors sell them along with the traditional financial assets. Thus, in the medium term, the forced correlation of bitcoin with stocks will lead to increased sales of crypto assets. However, in the opposite direction, this relationship may not be so relevant.

The FxPro Analyst Team