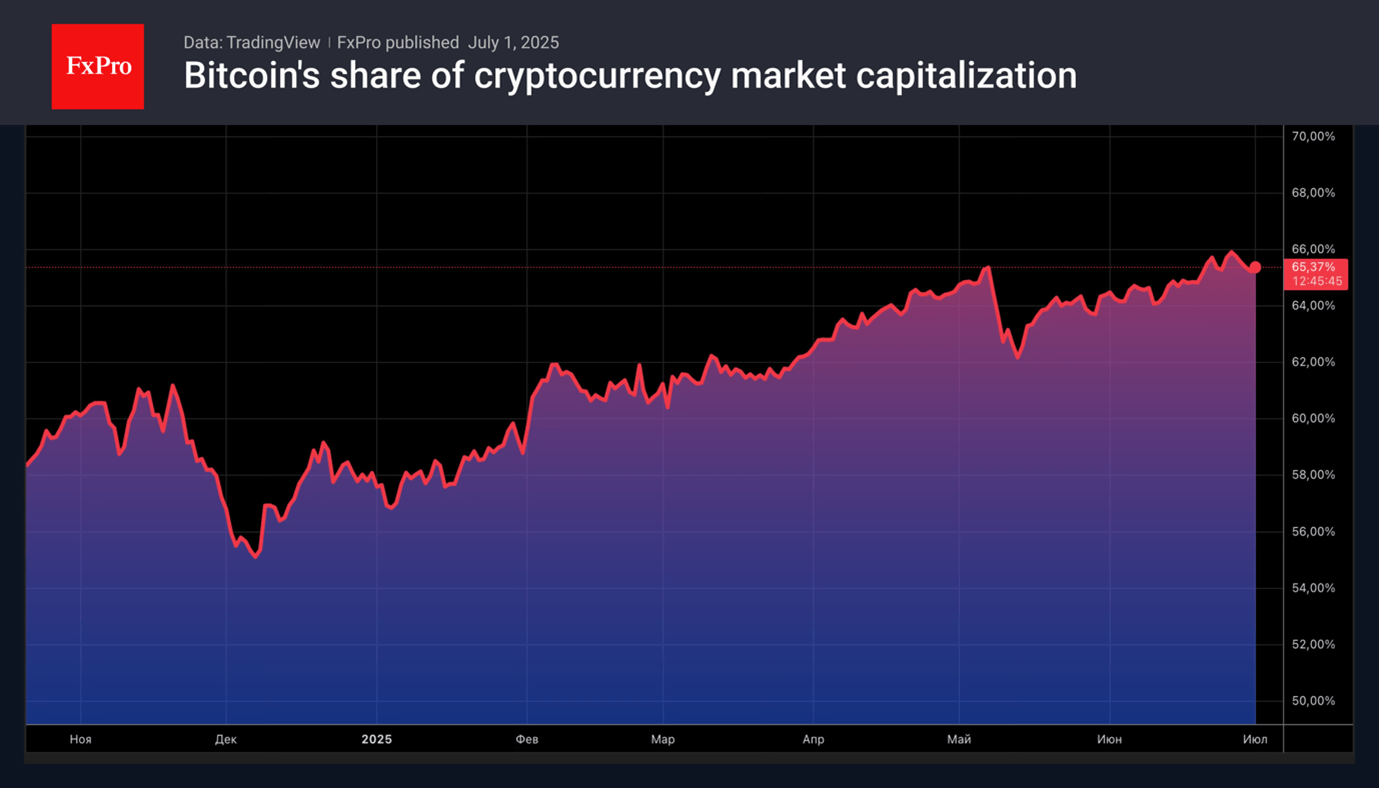

Bitcoin is absorbing most of the cash coming into the digital asset market. Its share in the cryptocurrency market structure increased by 10 percentage points to 65% in the first half of 2025. This is the highest it’s been since January 2021. In contrast the capitalisation of altcoins has fallen by $300 billion since the beginning of this year. Thanks to developed infrastructure, support from the White House and regulation, larger tokens are displacing smaller competitors.

The MarketVector Digital Assets 100 Small-Cap Index, which covers the bottom half of the 100 largest digital assets, initially doubled after Donald Trump’s election results in November. However, it then lost all its gains and fell by 50% in 2025. Bitcoin on the other hand, has risen by almost 14% since January and reached a new record high in May. Cryptocurrencies are benefiting from capital inflows into specialised exchange-traded funds and high global risk appetite.

The only competition for Bitcoin comes from stablecoins. The adoption by Congress of legislation regulating their circulation is increasing investor interest in this type of digital asset. In the first half of the year alone, the market capitalisation of stablecoins grew by $47 billion. Not only banks but also large companies such as Amazon are exploring opportunities for their implementation.

Bitcoin is showing little interest in restoring its correlation with US stock indices. The S&P 500 and Nasdaq Composite managed to update their record highs in June, but Bitcoin is in no hurry to do so. The link between the traditional markets and crypto was broken during the armed conflict in the Middle East. Currently the digital assets leader is cautiously watching the approach of the 9th of July, the expiry date of the White House’s 90-day tariff delay.

The escalation of trade wars will increase the risks of a pullback in US stock indices. According to Bank of America, the bubble in the US stock market continues to inflate. If it bursts, all risky assets will suffer. It is not surprising that Bitcoin is cautious. On the contrary, new records for the S&P 500 will allow bitcoin bulls to aim for a new all-time high.

The FxPro Analyst Team