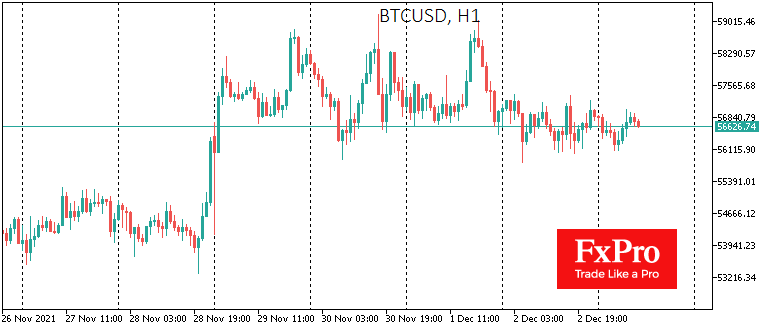

For the third day in a row, bitcoin is hovering around $56.7K with a slight downward bias. The pressure from traditional financial markets is already hard to speak of as there has been some rebound.

This time around, the stability of bitcoin dynamics is not a balance between a furious tug-of-war and a tight spring. Instead, we see neat selling on growth attempts, with bitcoin sellers turning the price around each time from ever-lower levels.

The Cryptocurrency Fear and Greed Index lost another point, dropping to 31. However, its reading seems somewhat outdated, as the top coins have been trending in green so far today. Over the past 24 hours, the total capitalisation of the crypto market has risen by 0.85% to 2.62.

During the week, a whole cycle of market sentiment shifted with a sharp dip, followed by recovery and a local renewal of highs. Still, already on Thursday, it was noticeable how enthusiastic buying was met with selling pressure.

It seems that retail and short-term investors in cryptocurrencies are keen to capitalise on a very successful year. That said, it is hardly fair to speak of any fundamental break in the bullish trend.

The market’s optimism is also supported by ETHUSD. It picked up on Thursday on a drawdown below 4500. We have yet to find out whether this was a sign of the end of a mini-correction.

This Friday promises to be very turbulent for the financial markets, which are near key levels ahead of the publication of the labour market data. It used to be the most unpredictable and meaningful market news, although now the Fed’s interpretation of the published data sets the tone.

The FxPro Analyst Team