Market Picture

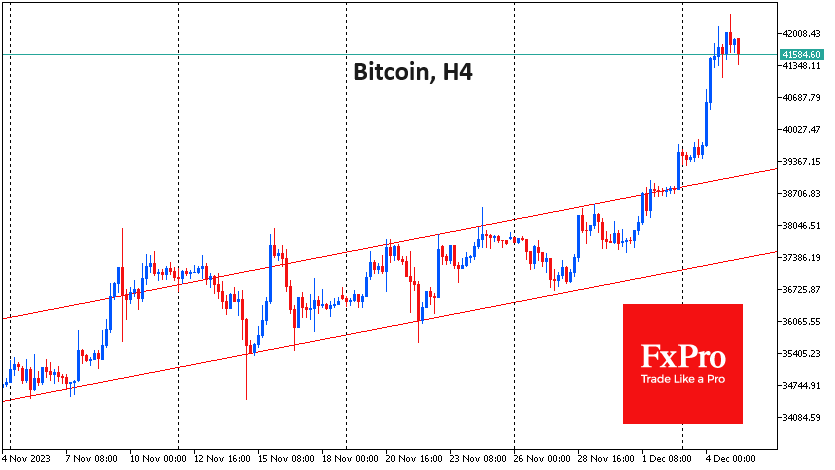

Bitcoin surpassed $42K on Monday, adding more than $2,000. The last time Bitcoin traded above $40K was in April 2022, before the collapse of the Terra ecosystem triggered a massive crypto market crash. Financial markets are seeing a second day of risk aversion, which has kicked off profit-taking in cryptos.

Bitcoin is losing 1.5% to $41.5K so far on Tuesday after a short squeeze into the $42.4K area. A broader move of profit-taking could take the price back to $40K before attracting new buyers.

According to CoinShares, crypto fund investments rose by $176 million last week; significant inflows continued for the sixth week in a row and the tenth week overall. Bitcoin investments increased by $133 million, Ethereum by $31 million, and Solana by $4.3 million.

Investments in crypto funds reached $1.76bn or 4% of assets under management in 10 weeks, the highest since October 2021 when the US futures ETF was launched. Trading volumes on ETPs remain strong at $2.6bn, CoinShares noted.

News background

Ledger CEO Pascal Gauthier, Lightspark CEO David Marcus and top CoinDCX exchange manager Vijay Aiyar told CNBC that they expect Bitcoin to rise to $100,000 in 2024.

Bitcoin will breach the $100K level before the upcoming halving in April 2024, according to industry veteran and Blockstream CEO Adam Back. Regarding the long-term movement of digital gold quotes, the entrepreneur agreed with BitMEX co-founder Arthur Hayes’ view of reaching levels between $750K and $1 million by 2026.

El Salvador’s investment in Bitcoin has fully paid off, with an unrealised profit of more than $3m, the country’s president Nayib Bukele said. El Salvador has no plans to sell digital assets and intends to pursue a “long-term strategy,” he said. The country currently owns 3,144 BTC ($130 million).

One of the main critics of the world’s first cryptocurrency, Peter Schiff, said that the speculative frenzy around bitcoin-ETFs will soon end, and Bitcoin’s collapse will be more impressive than its rally of recent months.

The FxPro Analyst Team