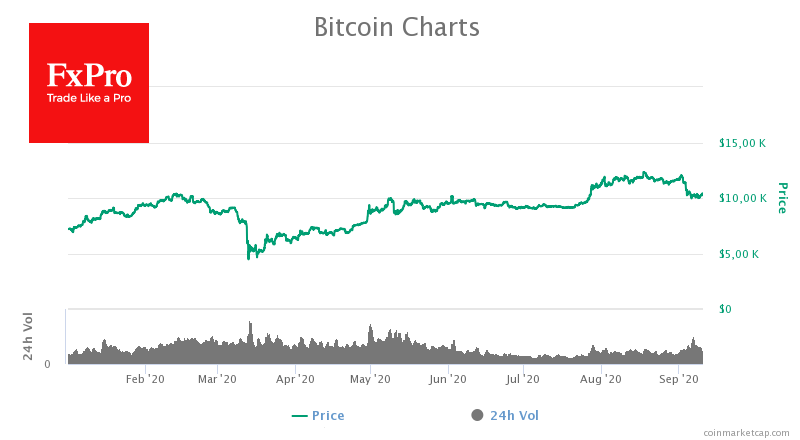

The crypto market survived the recent blow and refrained from a full-scale sale. Bitcoin is trying to bounce back from $10K, although it is lagging behind the overall market recovery. Since late May, the Bitcoin Domination Index has fallen by nearly 12%. The total capitalization of the crypto market increased by $78 billion over the same period. Glassnode noted that despite bitcoin’s decline from $12K to $10K, the number of holders (several incoming transactions without withdrawal of funds) increased by 2%. It is believed that these investors came to the market with long-term goals.

The leading altcoin Ethereum (ETH) demonstrates much higher growth. Despite the increase of transaction fees, which makes it inaccessible for regular users, the project attracts a lot of attention and has the potential for further growth, with decentralized financial applications the base of the impulse. Cryptocurrencies are still aiming to create a “superstructure” over the financial system. If Bitcoin were to fail, DeFi tokens will become more flexible and much more similar to the traditional banking sector.

Over time, DeFi cryptocurrencies could squeeze out Bitcoin, but they have a big problem: they are a threat to the financial monopoly of governments and banks. The situation can develop very unpredictably but past events show that regulators control everything, and in the case of significant competition, they can make quick decisions, limiting the capabilities of cryptocurrency.

Stablecoin staking has high potential because it combines 2 important features: a stable token price and a much higher yield than in the traditional banking sector, especially in current times when a deposit can be even taxed without making a profit.

The stability of different countries’ financial systems is perfectly tracked by the Chainalysis Cryptocurrency Adoption Index, which demonstrates that Ukraine, Russia, and Venezuela are the leading cryptocurrency users. Although these countries lag behind in terms of the volume of the largest transactions, their retail users are the most active in the world. The largest transactions still have their roots in the U.S. and China.

CryptoCompare estimates that the volume of crypto derivatives rose 54% in August to more than $700 billion, setting a historic high. Africa is quite predictably showing a large growth in demand for cryptocurrencies. Chainalysis data showed that transfers below $10K, which are attributed to retail investors and small businesses, jumped to more than $300 million in June. The number of monthly transactions exceeded 600k.

Over the next few years, we will be witnessing how emerging economies become the locomotive of crypto development. Since the regulators of these countries are often far from being as fast and experienced as in developed countries, and with a predominantly young population becoming more and more technologically literate, we can expect the development of crypto impulse from these regions of the world.

The FxPro Analyst Team