Market picture

The crypto market gained around 3% last week, taking its capitalisation to $1.06 trillion – the highest since late August. The market dip at the start of the previous week has fuelled buyers’ appetite.

But we are also seeing interest in crypto, in contrast to the sell-off in tech giants. We saw something similar in the spring as capital fled regional banks in the US. Isn’t it a sign that something is brewing in the banking sector again?

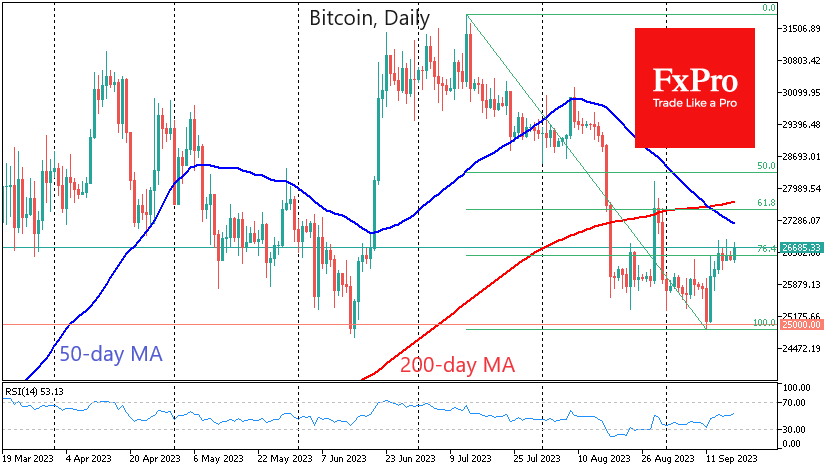

Trading at $26.5K, Bitcoin has recovered to 76.4% of the decline from the July peak to the September trough. Recent optimism shows that we could see a classical correction to 61.8%, near $27.5K. The 200-day moving average and the late August peak area are concentrated near that level. So, the battle for the trend, which has now eased slightly, is set to intensify.

News background

Bitfinex said investors withdrew $55 billion from the crypto market last month. August was the worst month for Bitcoin since November 2022.

The SEC has asked the court to unseal confidential documents in its case against Binance, Binance.US and CEO Changpeng Zhao. SEC lawyers argue that confidential material in the Binance case significantly delays the litigation and the regulator’s case.

Australian banking group ANZ completed a test transaction with the Australian dollar-backed stablecoin A$DC using Chainlink’s interconnect protocol.

Billionaire Mark Cuban was attacked by hackers who accessed his hot wallet and withdrew $870,000 worth of crypto assets. He said, the attackers infected his computer with a virus and waited patiently for him to log into his MetaMask wallet before they began withdrawing cryptocurrency.

The FxPro Analyst Team