Market Overview

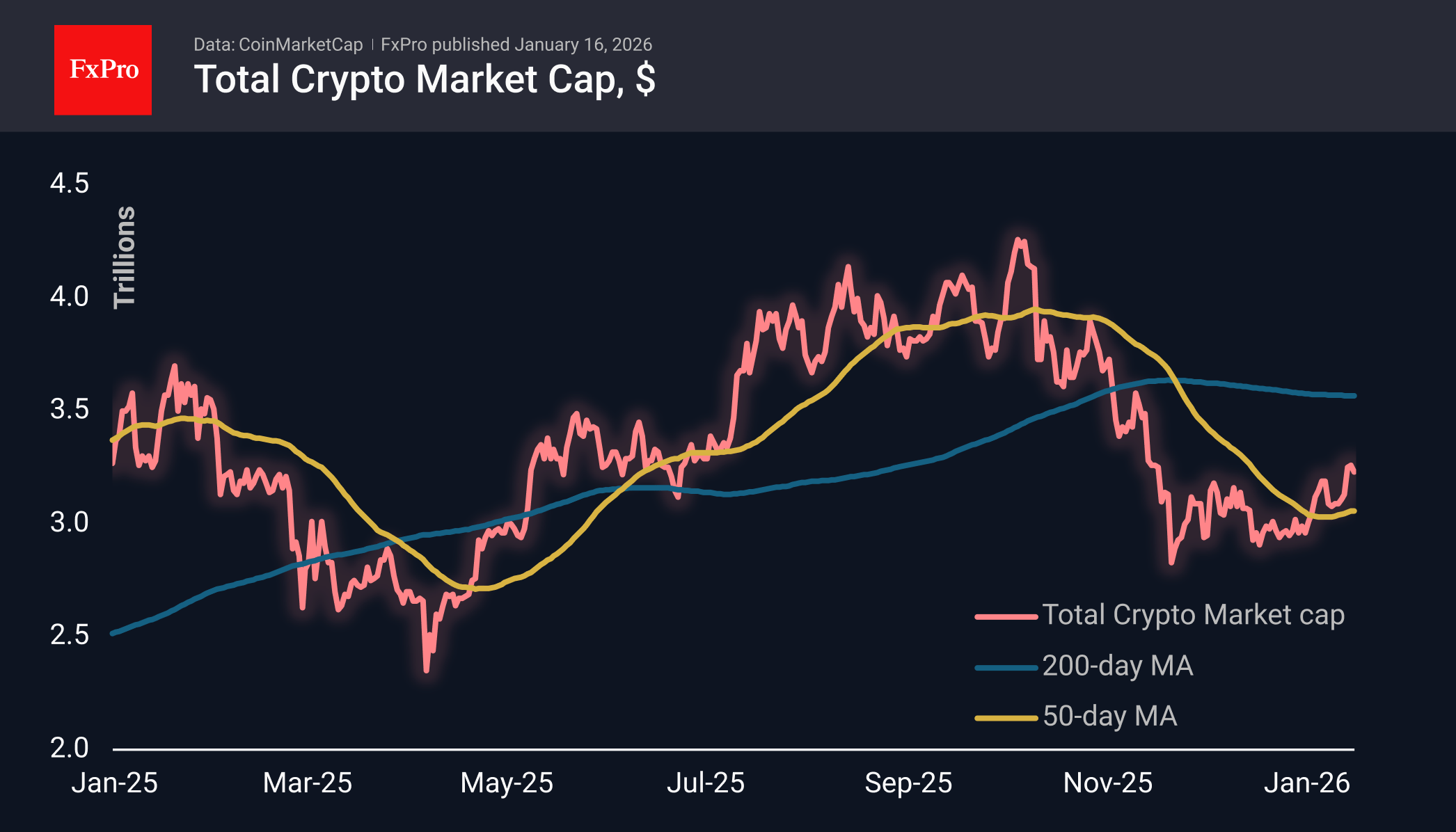

The crypto market has fallen 1.5% over the past 24 hours to $3.23 trillion as the market regains strength after the growth momentum at the beginning of the week. The top five cryptocurrencies by market capitalisation are down less than 1%, while smaller altcoins are experiencing more significant declines. The exception is Tron, which is up about 1% on the day and has been steadily gaining weight since the end of December.

Bitcoin is trading near $95.5K, retreating from levels near $98K, where the 61.8% Fibonacci retracement level also passes. The first cryptocurrency has reached the retracement line, waiting for further momentum to determine its direction. No critical macroeconomic publications are scheduled for the near future, so BTC will have to follow the highly unpredictable geopolitics and market reaction to quarterly reports.

News Background

Over the past three days, more than 47,000 retail investors have left the market due to fear, doubt and uncertainty. The price rebound was supported by a seven-month low in the volume of bitcoins on exchanges, according to Santiment.

The dynamics of the Value Days Destroyed indicator suggest that long-term holders are refraining from taking profits despite the rise in prices. The current growth is based on fundamental market strength rather than speculation, according to CryptoQuant.

According to CoinGlass, the total open interest in Bitcoin derivatives on all exchanges is now 28% below its peak in early October. A large-scale ‘cleansing’ of the market from excessive leverage could signal a recovery for BTC.

Despite the optimism, the derivatives segment has not yet entered a full-fledged growth phase, according to Greeks Live.

The recent growth was caused by a short squeeze in the futures market amid low trading volumes, rather than an influx of fresh capital, according to Glassnode. Despite the local positive, the options market signals that risks remain.

The US Securities and Exchange Commission (SEC) has closed a case initiated in August 2023 against the non-profit organisation Zcash Foundation, which is behind the development of the private coin.

The FxPro Analyst Team