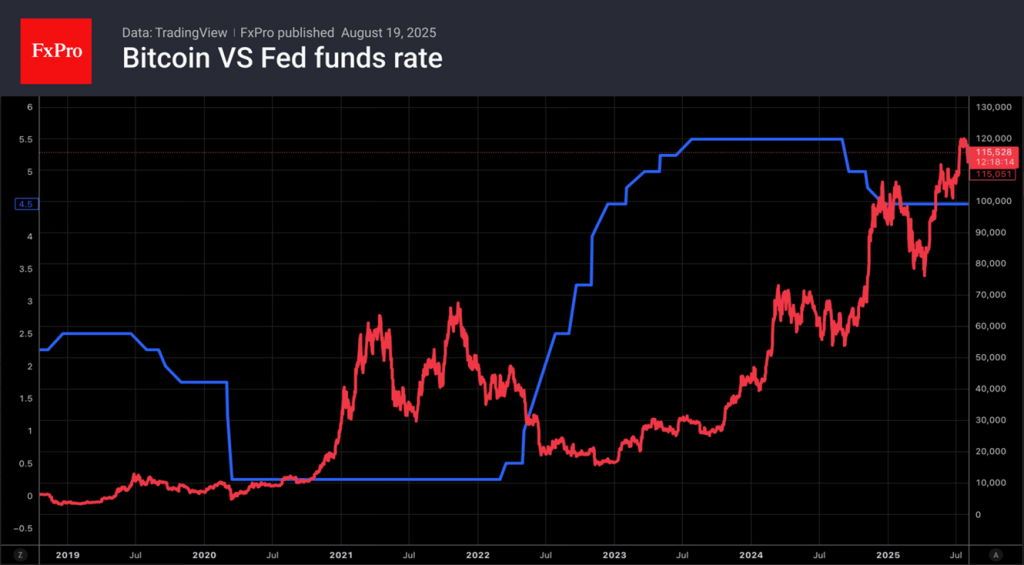

Accelerating US inflation and Treasury Secretary Scott Bessent’s comments on the US strategic reserve caused Bitcoin to plummet from record highs. The fastest growth in producer prices in three years has reduced the chances of the Fed resuming its monetary expansion cycle in September from almost 100% to 84%. The central bank may pause after lowering the federal funds rate. This will be a cold shower for risky assets, including cryptocurrencies.

Belief in an increase in US crypto reserves created a tailwind for Bitcoin. Investors speculated on how the White House would build up reserves. Will it be through tariffs? Revaluation of gold reserves? Or unique neutral budget strategies? Scott Bessent dashed the hopes of the digital asset market, stating that the United States does not intend to buy or sell Bitcoin. An increase in current reserves of $15-20 billion is possible in the event of further confiscations.

Investor disappointment resulted in a sell-off of Bitcoin. At the peak, its market capitalisation reached $2.5 trillion. However, as the bulls retreat, the indicator is declining. The Treasury Secretary has deprived the cryptocurrency of an important growth driver. Now it can only count on a further improvement in global risk appetite. The S&P 500 rally is unlikely to continue unless Jerome Powell announces a dovish shift in the Fed’s outlook at Jackson Hole.

A year ago, at a meeting of central bank heads, the Fed chairman announced a cycle of monetary policy easing. Now, mixed data is preventing him from announcing the resumption of this cycle. Purchasing managers’ indices paint a stagflationary background. Retail sales growth contradicts the decline in consumer confidence. Consumer prices have stabilised, but producer prices are accelerating.

Contradictory statistics for the United States are forcing the Fed to remain cautious. After lowering rates in September, the central bank may pause again, which will upset fans of risky assets and contribute to Bitcoin’s continued decline.

The FxPro Analyst Team