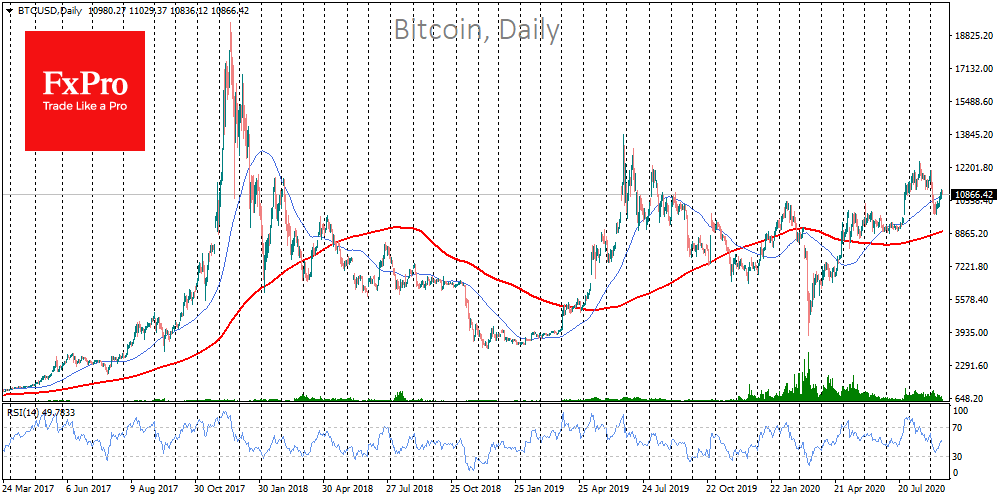

Bitcoin touched the round level of $11K but at $11,100 faced increased pressure from sellers. Over the last week, Bitcoin showed a 5% increase. The total capitalization of the crypto coin exceeded the symbolic $200 billion. The Crypto Fear & Greed Index for Bitcoin and the largest cryptocurrencies have grown by 5 points to the “neutral” level in a day. Thus, the indicator shows that there is room for further growth. The RSI index for the BTC/USD pair also confirms this.

Bitcoin has resisted the bears’ pressure below $10K, saving itself from falling further towards $9K and below. On its growth path, the coin will first have to overcome the $11,500 level and then make another attempt to reach $12K. The level of $12,500 will be the next frontier, and overcoming it may open a direct path to historical highs because Bitcoin hasn’t been able to consolidate higher for the last two years.

It is worth paying attention to the reduced volatility in Bitcoin in recent days, along with cautious price growth. This is more akin to careful buying following the optimism of global markets, rather than going all-in on the prevailing optimism.

Bitcoin futures with physical delivery at Bakkt showed record daily trading volume, exceeding $200 million in bitcoin contracts as of September 16th, up 36% from the previous high. Hence we are now witnessing growing interest from institutional investors after some stagnation.

Despite Bitcoin’s dependence on short-term signals of technical analysis, there are really strong market hopes for irrational growth and new impulses. When technical analysis ceases to work, we are getting the strongest driving force in any market.

The locked BTC tokens in decentralized financial applications can be this driving force. There is already a precedent with overcoming $40K in the market (yearn.finance, YF)), while the capitalization of Bitcoin is much higher and the response to a decrease in the number of coins in circulation can also be much stronger. According to DeFi Pulse, currently, more than $1 billion worth of bitcoins are tokenized in Ethereum applications. The total volume of the DeFi market is about $8.5 billion. The popularity of ETH-protocols for passive profits from holding Bitcoin may become the next price trend for the first cryptocurrency.

Halving can enhance the effect of Bitcoin locked in DeFi, as it creates the same function by reducing the award to the miners. At the same time, the peg between traditional markets and Bitcoin should not be overlooked. The latter is often another way to diversify a portfolio, so BTC is vulnerable to large sell-offs along with other risky assets. What will be stronger: institutional investors or reduction of turnover by locking coins in applications? – we will soon find out.

The FxPro Analyst Team