Market picture

The crypto market rose another 0.5% over the past 24 hours to $2.75 trillion. The Cryptocurrency Fear and Greed Index remained at 81 (extreme greed). But the past day was not a quiet one.

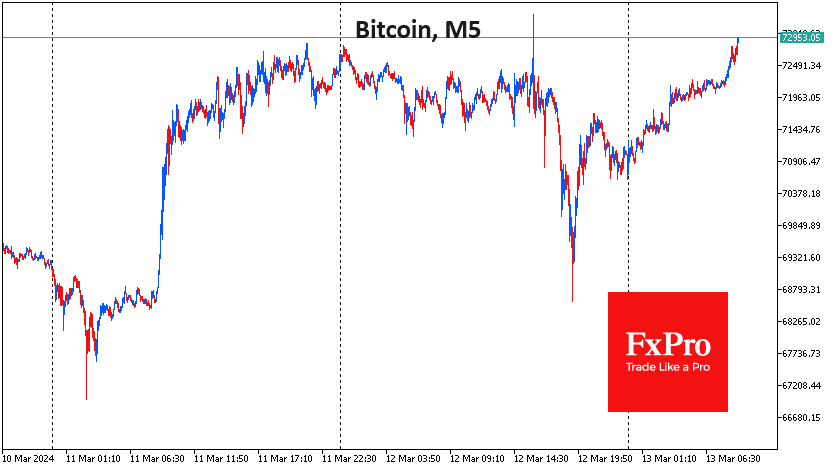

Bitcoin briefly broke above $73K in a sharp move, triggering an avalanche of stop orders that drove the price down 6.5% over the next three hours to $68.6K – precisely the level from which the last rally began on Monday.

This pullback was considered an opportunity for those looking to get in at the rally, and there appear to be quite a few. The intraday nature of the move is reminiscent of the behaviour of large institutional traders, with trading algorithms intercepting the move and retail traders often joining in. Either way, the overall trend remains bullish, and Bitcoin is climbing back towards its highs as we head into early European trading.

News background

The depth of liquidity in the bitcoin market, as measured by the value of exposures in order books within 2%, reached a record $600 million, Kaiko noted. The number of bids significantly exceeded the number of asks, suggesting profit-taking by traders as historical highs were updated. The persistence of refinancing rates near the highs suggests that demand for the asset is resilient.

BTC trading volume on spot platforms reached $51 billion, surpassing the values of the 2021 bull market. At the same time, Tether’s capitalisation reached an all-time high ($100bn).

Just two months after the launch of the first spot bitcoin ETFs in the US, the assets under management at BlackRock’s IBIT fund surpassed 200,000 BTC ($14.6 billion).

Given the pace of capital inflows into spot bitcoin ETFs, there will be a shortage of BTC supply in six months, CryptoQuant estimates. Currently, there are only 1.4 million BTC available in the market for bitcoin ETFs.

Bloomberg lowered the chances of spot Ethereum ETFs launching in May to 35% from 70%. The reduced optimism is due to the SEC’s low level of involvement in negotiations with issuers. Other challenges to a favourable verdict are the PoS mechanism, the risk of price manipulation and the recognition of the asset as a security.

The non-custodial cryptocurrency wallet MetaMask has begun testing Mastercard’s payment onchain. The joint product will be “the first truly decentralised web3 payment solution”. Users will be able to spend cryptocurrency “on everyday purchases wherever cards are accepted”.

The FxPro Analyst Team