Market picture

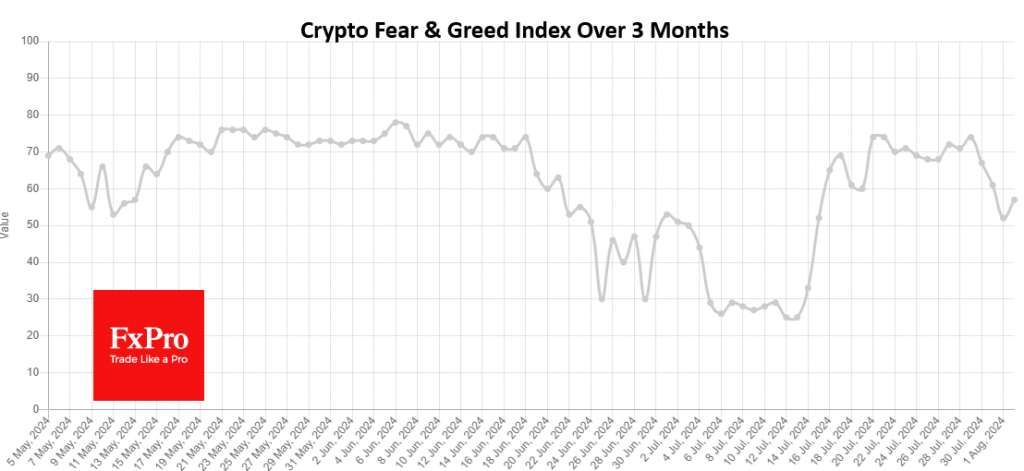

The crypto market lost 0.75% in 24 hours to $2.29 trillion. A day earlier, we noted a decline in cryptocurrencies in contrast to the positivity in equities on Wednesday, and then synchronised selling prevailed on Thursday. Meanwhile, the sentiment index remains at 57 (greed). This is bad news for the market right now, as a state of fear might have attracted buyers on downturns, but now they will wait for a bigger drawdown.

At the same time, the bulls in Bitcoin are leaving important levels behind them, having managed to push back from the 50-day moving average. The price change over the past 36 hours is small (-0.6%), but this result masks a 5.5% jump in price in the five hours after touching lows near $62.3K on Thursday night.

Current levels fit into a corrective pattern from the July price amplitude. However, it is difficult to rely on this short-term pattern ahead of labour market data, with volatility spiking in equities.

News background

Bitcoin’s hashrate drawdown from its all-time high is just 3%, down from 8% as of 9 July, and a recovery in the index is usually associated with a sustained rally, CryptoQuant noted. BTC’s hashrate growth will contribute to the stability of its price.

At the end of July, the Solana ecosystem surpassed Ethereum for the first time in terms of trading volume on decentralised exchanges—$55.8 bn versus $53.8bn. The hype around Solana-based meme tokens probably influenced the growth of the metric.

USDT issuer Tether posted a record net profit of $5.2bn in the first half of the year, of which approximately $1.3bn was interest income from US government bonds. The company received another ~$3.9bn due to the increase in the value of positions in bitcoin and gold.

Telegram developers unveiled new features in the messenger, including a browser with support for TON-based Web3 browsing and a mini-app shop. The internal currency Telegram Stars can now be gifted to contacts via the Settings section.

The FxPro Analyst Team