Market Picture

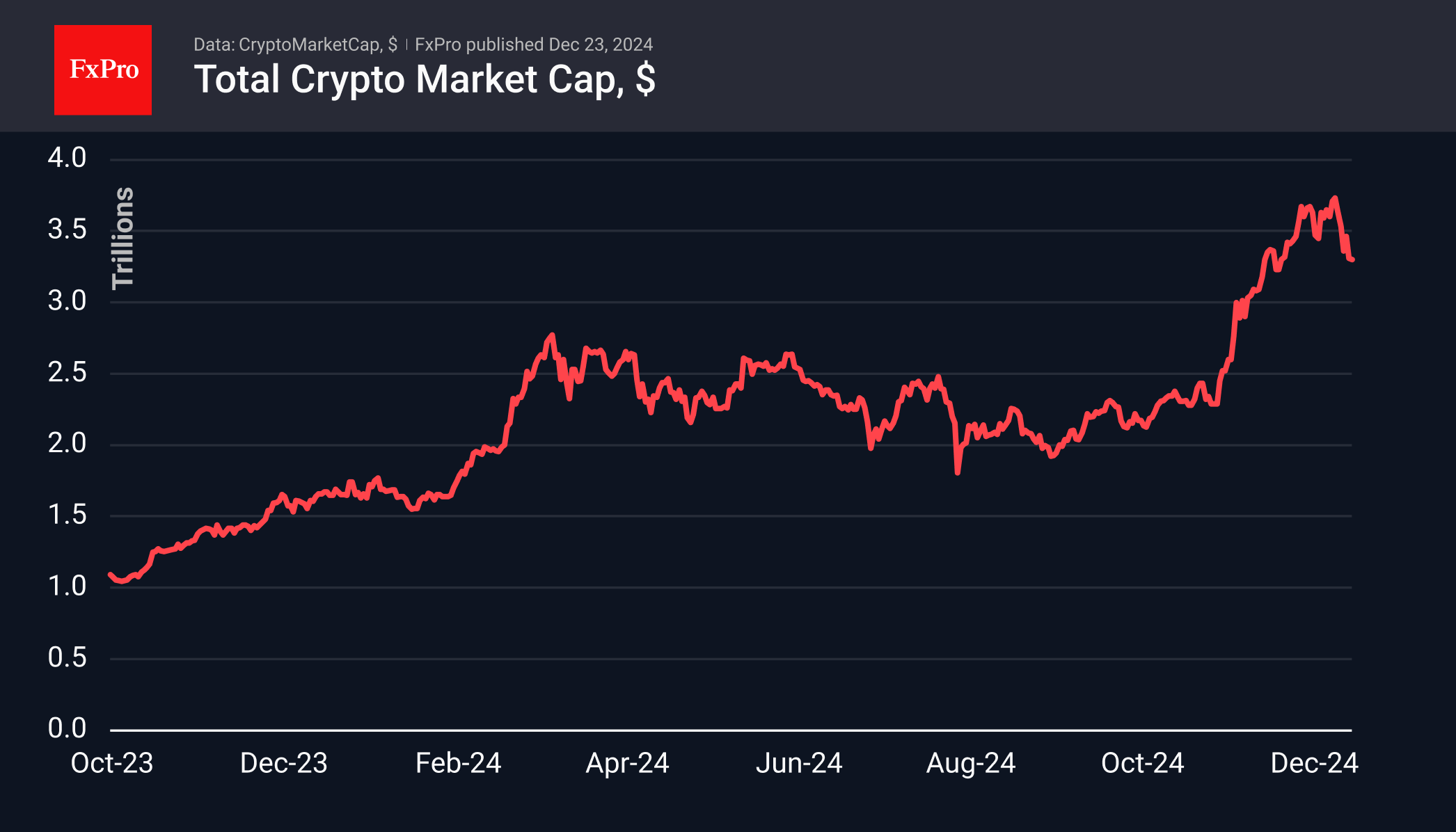

The crypto market retreated last week and is in no hurry to recover, remaining at $3.31 trillion, roughly where it was 30 days ago. The sharp dip below $3.2 trillion was also quickly bought back, but a full-blown rebound is yet to be seen. Markets continue to digest the Fed’s tougher tone, reinforced by the accumulated urge to lock in profits after a strong year.

The Crypto Market Sentiment Index is in neutral territory, compared to the shuttling between fear and extreme fear in US stocks.

Bitcoin is trading around $95.5K, receiving support near the 50-day moving average on Friday and Monday. While we expected to see the market decline here, it’s too early to say this is the end of the correction. Further declines in the stock market, of which there are many in Bitcoin and Ethereum, could trigger institutional investors, launching a deeper pullback.

Reduced holiday liquidity has the potential to amplify this amplitude. In a potential shock scenario, they see a dip into the $70K area. However, there are more chances that a pullback to $90K in the next couple of weeks will be attractive enough for buyers to stop the sell-off.

News Background

Matrixport expects that the first cryptocurrency could see a strong start in early 2025. Messari predicts that Bitcoin and real-world tokenised assets (RWAs) will be the focus of investor attention in 2025.

The average duration between Bitcoin’s first and last all-time high (ATH) in a cycle is 318 days, K33 Research noted. If the pattern repeats, the next global peak will be reached on 17 January, before the inauguration of US President-elect Donald Trump. Analysts noted an increase in coins available on the market to the highest since 2021 (22% of supply), driven by Mt. Gox proceeds and government sales.

The US SEC approved the first spot ETFs combining Bitcoin and Ethereum, issued by Hashdex and Franklin Templeton.

El Salvador will expand BTC purchases in defiance of the IMF deal. El Salvador’s National Bitcoin Office said the country will continue to buy the first cryptocurrency and possibly at an ‘accelerated pace’.

US mining company MARA has launched a second project in Finland to use the heat generated by cryptocurrency mining for home heating. With this latest initiative, 80,000 residents of the country will be provided with heat generated by mining equipment.

The FxPro Analyst Team