Market picture

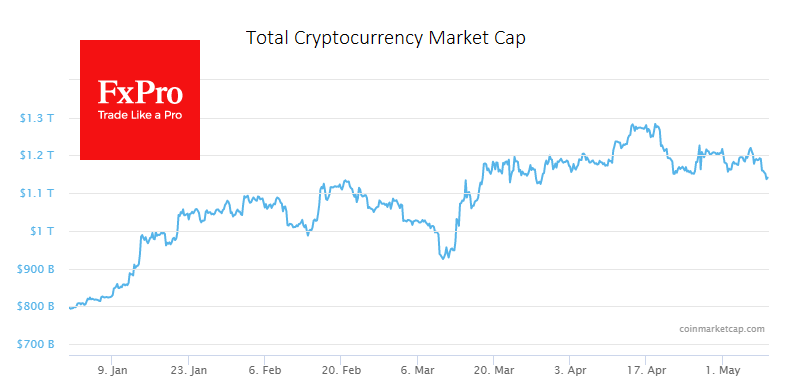

The total capitalisation of the cryptocurrency market fell by 2% to $1.14 trillion over the last 24 hours. Over the same period, bitcoin lost 2.6%, Ethereum lost 1.7%, and the top 10 altcoins lost between 1.4% (BNB) and 5% (Polygon).

Bitcoin lost around $1500 on Monday to $28.5K amid rumours of a possible collapse of Binance. The world’s largest cryptocurrency exchange twice suspended BTC withdrawals due to network congestion.

The technical picture shows local victory for the bears, as the sharp drop in price started from the downside resistance that has been in place since the middle of last month. In a strong move, the price broke below the 50-day moving average for the first time since March 13th. The price is testing support near $27K, from which the coin has been rallying for the past two months.

Fees on the Bitcoin network hit a record high on May 8th. In some cases, transaction fees on the BTC blockchain exceeded $10K, with block 788762 setting the record for the day costing $15,834. The BTC network processes around seven transactions per second and cannot quickly confirm payments when users are active, causing queues to form.

According to CryptoQuant, users withdrew over 195,000 BTC (over $5.6 billion) from Binance in one day. In addition, according to Bloomberg, the US Department of Justice has launched an investigation into the exchange, suspecting it of violating sanctions against Russia.

News background

YouTube analyst Jason Pizzino said that negative news failed to stop Bitcoin’s rally after a strong bearish signal after the $20K breakout failed in early March. He believes BTC should soon be in the $32K to $42K range.

According to Validus Power, investment in bitcoin, gold and real estate can protect investors against losses related to the banking crisis.

The prime minister of Liechtenstein said the country would allow citizens to pay for public services using Bitcoin. He also did not rule out the possibility of the state investing some of its reserves in BTC.

Famous investor and head of Berkshire Hathaway, Warren Buffett, said that people’s loss of confidence in the dollar does not mean that Bitcoin will become a global reserve currency.

Argentina’s central bank has banned the sale of cryptocurrencies through payment applications. The regulator said it was trying to reduce the financial risks that transactions in digital assets could pose.

The FxPro Analyst Team