Market picture

Bitcoin was almost flat on Thursday but started Friday with a 6% plunge, momentarily dropping to $21.5K. Ethereum is losing 4.5% overnight to $1760. Leading altcoins are down 7% (XRP) to 12% (Solana).

Total crypto market capitalisation is down 4.2% to $1.07 trillion, according to CoinMarketCap.

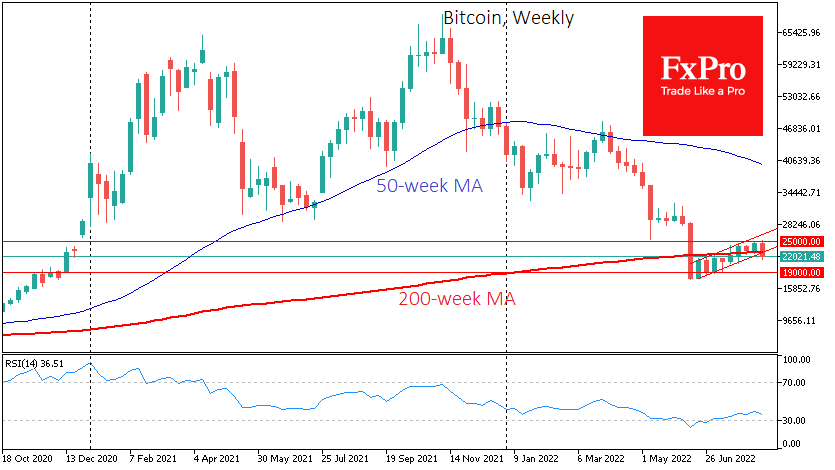

Bitcoin’s fall below $22.5K is a formal break of the upward corridor of the past two months, as a sequence of increasingly higher local lows is broken. Currently, BTCUSD is testing the 50-day moving average, which could act as an uptrend indicator.

The current dip has made the fight for the 200-week average, which is now near $23K, relevant again. Closing the week below this level risks triggering another round of liquidation.

Altcoins are losing even more significantly, reflecting a dramatic shift in enthusiast sentiment from cautious buying to simultaneously locking in quick profits across a wide range of coins.

Additionally, the weakening of global equity indices and the deteriorating macroeconomic backdrop is worrying factor. At the same time, the crypto market is no longer oversold but not yet attractive to long-term investors.

We believe we will see similar sharp market movements again in the coming months.

News background

Arthur Hayes, former head of crypto exchange BitMEX, talked about two scenarios after Ethereum moves to the Proof-of-Stake (PoS) mining algorithm. If the fork is unsuccessful, ETH could fall sharply but hold above $800. If the merger is successful, an ETH rally should be expected, although it may be delayed, as in the case of bitcoin halving.

Korean authorities are investigating 16 crypto exchanges accused of breaking local laws and providing digital asset trading services to Korean citizens.

Tether, the issuer of the largest USDT stablecoin by capitalisation, has announced a partnership with accounting firm BDO Italia. Tether plans to move from reporting quarterly financial results to monthly reporting.

The FxPro Analyst Team