Market picture

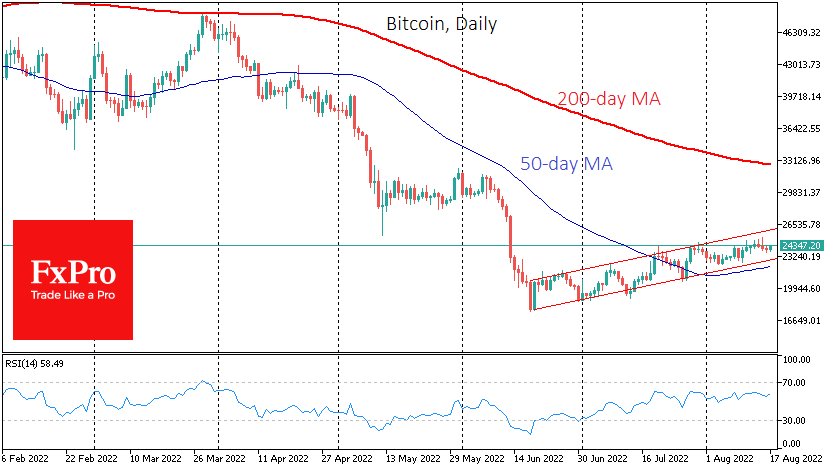

Bitcoin has added 1.5% to $24.3K in the past 24 hours. Over the past couple of hours, the first cryptocurrency has regained Tuesday’s slump, finding support from buyers at last Friday’s local lows.

Ethereum, following trends in recent weeks, is returning the drawdown even more vividly, adding 3.3% overnight to $1940. Top altcoins are rising between 1.7% (BNB) and 11.3% (Dogecoin).

The total capitalisation of the crypto market, according to CoinMarketCap, rose 2% to $1.16 trillion overnight.

Gold and silver crypto are firmly in an uptrend corridor, turning to rise today before touching the lower boundary.

Dogecoin was the highest gainer in the top 100 crypto assets, adding around 30% for the week. Another dog coin, Shiba Inu, is also growing. The community has already managed to call it a dog race. In both cases, it is a manifestation of retail investor activity, like the run-up in meme stocks that is happening again in the stock markets.

News background

According to Arcane Research, miners have been selling more BTC than mining for three consecutive months since May. While bitcoin’s rise in July has eased the pressure on miners, they continue to sell off previously accumulated stockpiles.

PayPal, the largest electronic payment system, has added the ability to buy, sell and transfer cryptocurrencies via a mobile app. One of Brazil’s largest banks, BTG Pactual, has launched a platform for investing in cryptocurrencies.

The US Federal Reserve is issuing new rules for cryptocurrency banks, under which they can be granted master accounts, a key financial status, allows direct payments and access to the regulator.

The European Union authorities will create a new regulatory authority, AMLA, to directly oversee the industry.

The FxPro Analyst Team