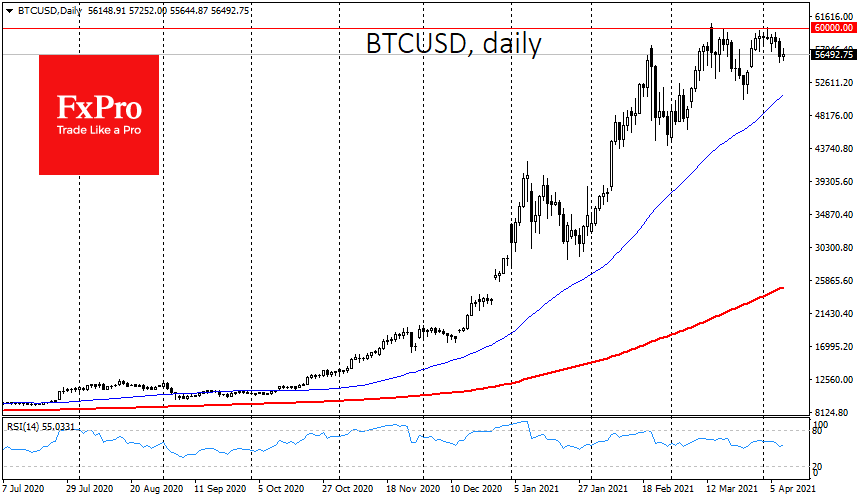

On the penultimate day of the workweek, Bitcoin is down 2% and trading at $57,000. The crypto market gave the community a big scare yesterday, reminding investors of the time when altcoin season was replaced by a sharp sell-off, including Bitcoin itself, becoming a trigger for the panic sentiment. Nevertheless, this time all ended well, and the benchmark cryptocurrency already stopped the decline on the approach of $55,600. At approximately the same time, altcoins also stopped falling.

The Bitcoin price was able to rebound, and although altcoins often cannot boast of the same, this time is different. The leading altcoin Ethereum briefly fell to $1,900 but is now back above $2K, though it is showing a decline of more than 3.5% overnight. Other top 10 altcoins were also revived after the correction, pointing to an unrealized demand in the market.

The star of the latest episode of the altcoin rally was the XRP token. As negative as the coin’s outlook has been in recent months since the SEC litigation began, the token’s rebound has been just as widespread after news broke that Ripple’s lawyers are finally succeeding in their confrontation with the SEC. Attorneys secured the right to gain access to SEC documents that defined BTC and ETH as “non-security instruments.” The XRP token has also come under correction pressure, losing 5% in a day, but it is now trading close to $1, which was very difficult to imagine in the recent past.

The total capitalization of the crypto market fell to $1.9 trillion because of yesterday’s correction. However, given the magnitude of the growth, we can consider the size of the correction to be very small. The latest episode of price fluctuations may also have been influenced by the “Kimchi premium”.

South Korea and Asia, in general, have a rather bright penchant for exciting technological innovation, so you can often see a significant premium to buy Bitcoin there. The scale was such that the regulator had to intervene to cool the situation down. As a result, a sell-off began, and the Bitcoin buying premium dropped to 11.5%.

Thus, not only people in Africa or Venezuela, where there is no stable currency or understanding of what is going on in the economy in general but also technologically developed countries, the crypto boom originators, are willing to pay significantly more for Bitcoin. Nevertheless, the “Kimchi premium” is an unstable indicator, as no one paid attention to it when three months ago, Bitcoin in Korea was trading cheaper than the rest of the world.

The FxPro Analyst Team