Market Overview

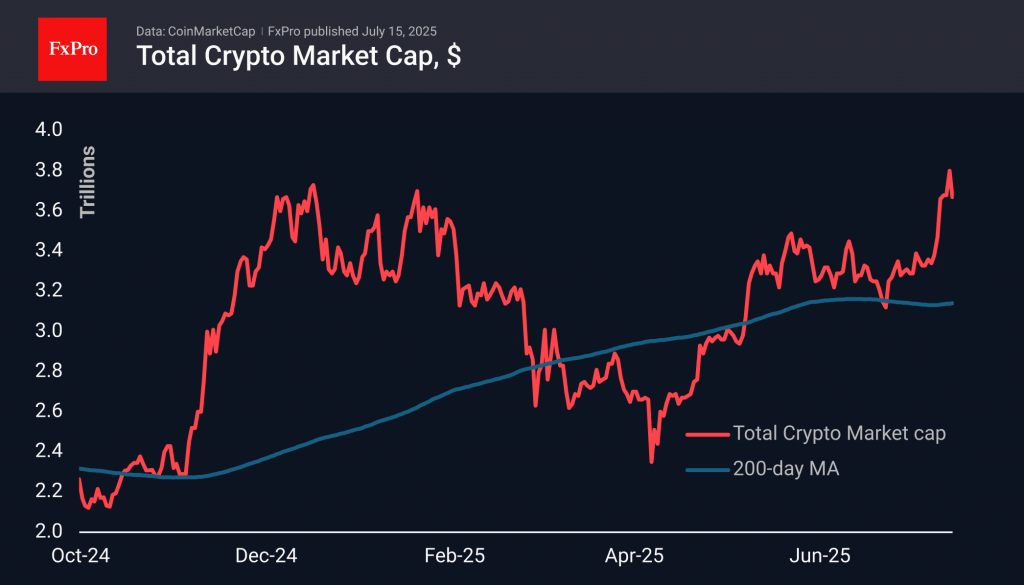

The crypto market cap retreated 3.5% to $3.67 over 24h after Bitcoin’s sharp dive in the middle of the European session on Monday. Notably, stock indices continued to move upwards, confirming no radical change in risk appetite.

Bitcoin was one of the main victims of sharp profit-taking, falling 4% in 24 hours to $117K after setting a record at $123K. This is significantly higher than the last peak of $112K, so there is no point in talking about a reversal. At the same time, we are getting further confirmation of a change in the nature of the market with more frequent profit-taking. It is becoming the norm for very long-term buyers to join in the selling.

Ethereum also experienced a 5% pullback to $2930 from its latest peak but quickly returned to growth on Tuesday morning to $2980. Judging by its dynamics, crypto traders are bullish, assuming only a short-term pullback.

News Background

According to CoinShares, global investment inflows into crypto funds last week amounted to $3.717 billion, the second largest in recorded history. Investments in Bitcoin increased by $2.731 billion, Ethereum by $990 million, Solana by $93 million, and Sui by $4 million. The XRP token saw a record weekly outflow of $104 million.

Cryptocurrency ETFs saw inflows for the 13th consecutive week, increasing investments since the beginning of the year (YTD) to $22.7 billion. Assets under management (AuM) reached a new record of $211 billion. Bitcoin ETF AuM exceeded $179 billion, already accounting for 54% of gold ETF AuM, according to CoinShares.

Bitcoin’s market capitalisation reached $2.4 trillion. This figure exceeded the capitalisation of Amazon ($2.3 trillion) and silver ($2.2 trillion).

There are no signs of active coin selling on the market. According to CryptoQuant, crypto wallets that only buy Bitcoin have increased their activity by 71% over the past month.

The latest recalculation increased the difficulty of mining Bitcoin by 7.96% to 126.27 T. The indicator approached the historical maximum of 126.98 T recorded in May.

Market data indicates the start of the altcoin season, but according to Santiment, there are warning signs. CoinMarketCap’s alt season index is at 27, indicating that market participants still prefer Bitcoin.

The FxPro Analyst Team