Market Picture

The crypto market made an impressive move higher, rising 3.4% in 24 hours to $1.71 trillion. The rise to its highest level since 12 January came as the S&P500 and Nasdaq-100 indices hit all-time highs.

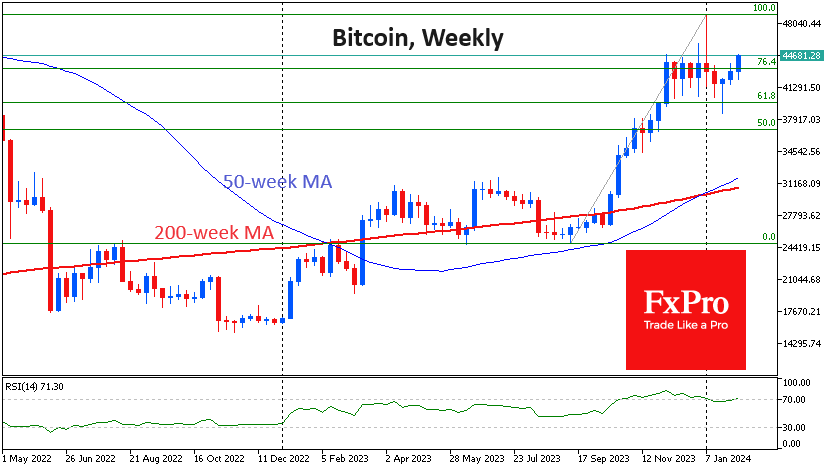

Bitcoin rose above its 50-day moving average, confirming the bullish medium-term trend and easing fears of a deeper correction. On a weekly basis, bitcoin is now above its December-January closing levels, although intra-week volatility briefly pushed the price higher earlier in the year. However, weekly closes are the more important benchmark for the markets.

Technically, bitcoin and the broader crypto market have gained strength after a long period of consolidation and are now poised to make new highs. The Fibonacci pattern is almost perfect: the rally from $25K to $49K ended with a 61.8% retracement of the initial move. Theoretically, a break of the highs at $49K would confirm the pattern and make $64K (161.8%) a target.

News Background

MicroStrategy bought an additional 850 BTC worth $37.2 million in January, bringing its reserves in the first cryptocurrency to 190,000 BTC (around $8.5 billion) at an average price of $31,224.

According to CoinLedger, the average realised gain for crypto investors in 2023 was $887.6, compared to a loss of $7,102 in the previous year.

The US SEC has delayed a decision on applications for spot Ethereum ETFs from Invesco and Galaxy. ‘The only date that matters for spot ETH ETFs at this point is 23 May. That’s the deadline for VanEck’s application’, notes Bloomberg.

Ethereum developers have successfully implemented the Dencun (Deneb-Cancun) update on the Holesky test network. It is expected to reduce commissions for L2 solutions based on roll-up technology by around ten times.

Thailand’s Ministry of Finance announced that crypto trading will be exempt from value-added tax. The agency aims to encourage the country’s transformation into a hub for digital assets and promote them as an alternative means of raising capital.

The CEO of South Korean cryptocurrency exchange Bitsonic, Jinwook Shin, was sentenced to seven years in prison for his involvement in a 10 billion won ($7.5 million) fraud scheme.

According to TheMinerMag, bitcoin mining by US miners fell to historic lows in January due to a 29-50% increase in electricity prices. High electricity costs are expected to continue until the end of the first quarter of 2024.

The FxPro Analyst Team