Market picture

Bitcoin managed to claw its way to a meaningful round level early in the week, trading at $20,400 on Tuesday morning (+2.8% in 24 hours). Ethereum showed an even more decisive rebound, adding 8.5% at once to $1580. Top altcoins are up 3.5% (Dogecoin) to 7.1% (Solana).

Total cryptocurrency market capitalisation, according to CoinMarketCap, rose 4.2% overnight to $992bn. The cryptocurrency Fear and Greed Index rose 3 points to 27 by Tuesday and moved into “fear” from “extreme fear”.

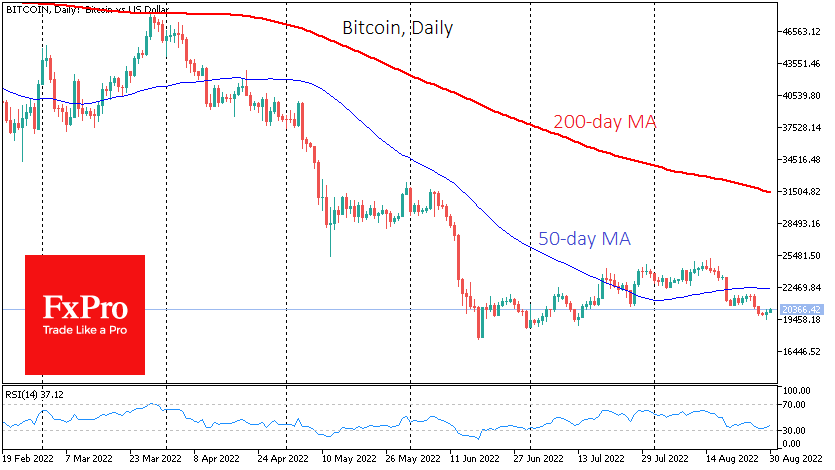

Bitcoin was getting support on Monday on declines under 19500. It attracted buyers roughly at the same levels in July. One can cautiously state that the bears’ impulsive attack has been stopped, preventing the first cryptocurrency from updating lows. Such buybacks slowly create a sense that the bottom is near. This dynamic has encouraged a broad layer of buyers, who quickly returned to buying one of the robust fundamentals of recent months, Ethereum.

News background

According to CoinShares, net capital outflows from cryptocurrencies last week were $27m, with investors taking money out for the third week. Meanwhile, outflows from bitcoin funds accounted for $29 million, with investments in funds that allow shorts on bitcoin up by $1 million.

BTC is unique because it is technically one of the worst cryptocurrencies and solely a speculative asset without utility, said Cyber Capital founder and chief investment officer Justin Bones. He was previously a supporter of the first cryptocurrency but changed his view due to the community’s refusal to increase the block size limit.

Cardano beat out bitcoin in MBLM’s Consumer Emotional Affection ranking, ranking 26th out of 600 global brands. Bitcoin ended up in the 30th position.

Former US broker Jordan Belfort, known as “The Wolf of Wall Street”, sees bitcoin and Ethereum as primarily solid digital assets because of their strong fundamentals but compares the cryptocurrency market to junk bonds from the 1980s.

Meanwhile, the Chicago Mercantile Exchange (CME Group) has launched euro-denominated futures on bitcoin and Ethereum.

The FxPro Analyst Team