Market picture

Crypto market capitalisation rose 5.2% over the past seven days to $2.41 trillion. Over the weekend, it reached $2.44 trillion, its highest level in nearly four weeks.

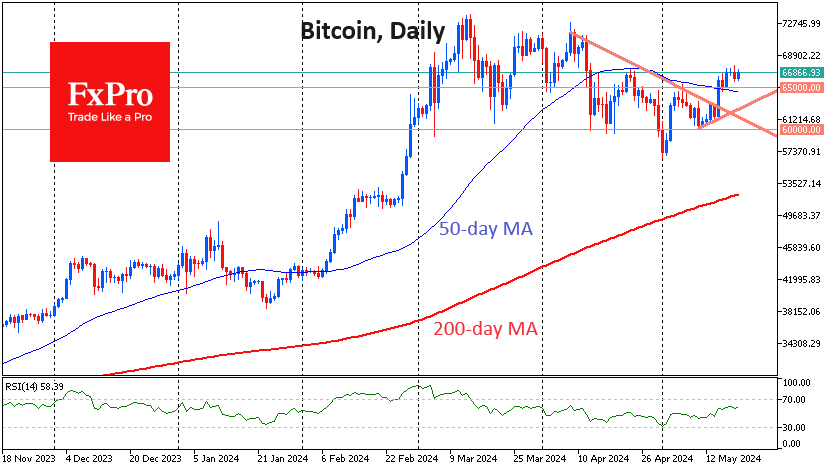

Bitcoin is treading near local highs, remaining just below $67K. That’s a gain of 8.4% in seven days and a retest of the previous peak area in late April. Despite the burgeoning risk appetite in global markets, demand for Bitcoin, Ethereum and many altcoins is rather subdued. However, BTCUSD remains firmly above the 50-day moving average, indicating an upward trend.

Investors are more optimistic about Solana, whose price rose to its highest since early April at $177 (+1.5% in 24h). It may well reach the March highs before Bitcoin, acting as a more sensitive indicator of risk appetite in cryptocurrencies.

News background

According to Arbelos Markets, the correlation between bitcoin and the Nasdaq-100 index has returned to its highest levels since late summer 2023. Investors now view BTC as an asset identical to tech stocks.

According to JPMorgan, the cost of mining Bitcoin has reached $45,000, up $3,000 from its previous estimate. The bank kept its medium-term forecast for BTC at $42,000 due to limited inflows into spot bitcoin-ETFs.

CoinGecko compared blockchains in terms of speed records. The fastest network was Solana—on 6 April, the daily average number of transactions per second (TPS) reached a record high of 1,504 against the backdrop of the meme-coin boom. This makes Solana 46 times faster than Ethereum and more than five times faster than Polygon, which has the highest TPS among scaling solutions. Sui, BNB Chain, Polygon, and TON are next in line.

MN Trading founder Michael van de Poppe sold all bitcoins and bet on altcoins but promised to return to BTC later. The community noted the riskiness of this strategy; some believe the time for altcoins is not yet ripe.

Venezuela has banned cryptocurrency mining to stabilise the national energy grid. Authorities say the country’s energy security is more important than the digital asset mining industry.

According to BitRiver, miners from the Russian Federation mined 54,000 BTC ($3.5bn at current exchange rates) last year. At the end of the year, the Russian Federation ranked second in terms of cryptocurrency mining, second only to the United States.

The FxPro Analyst Team