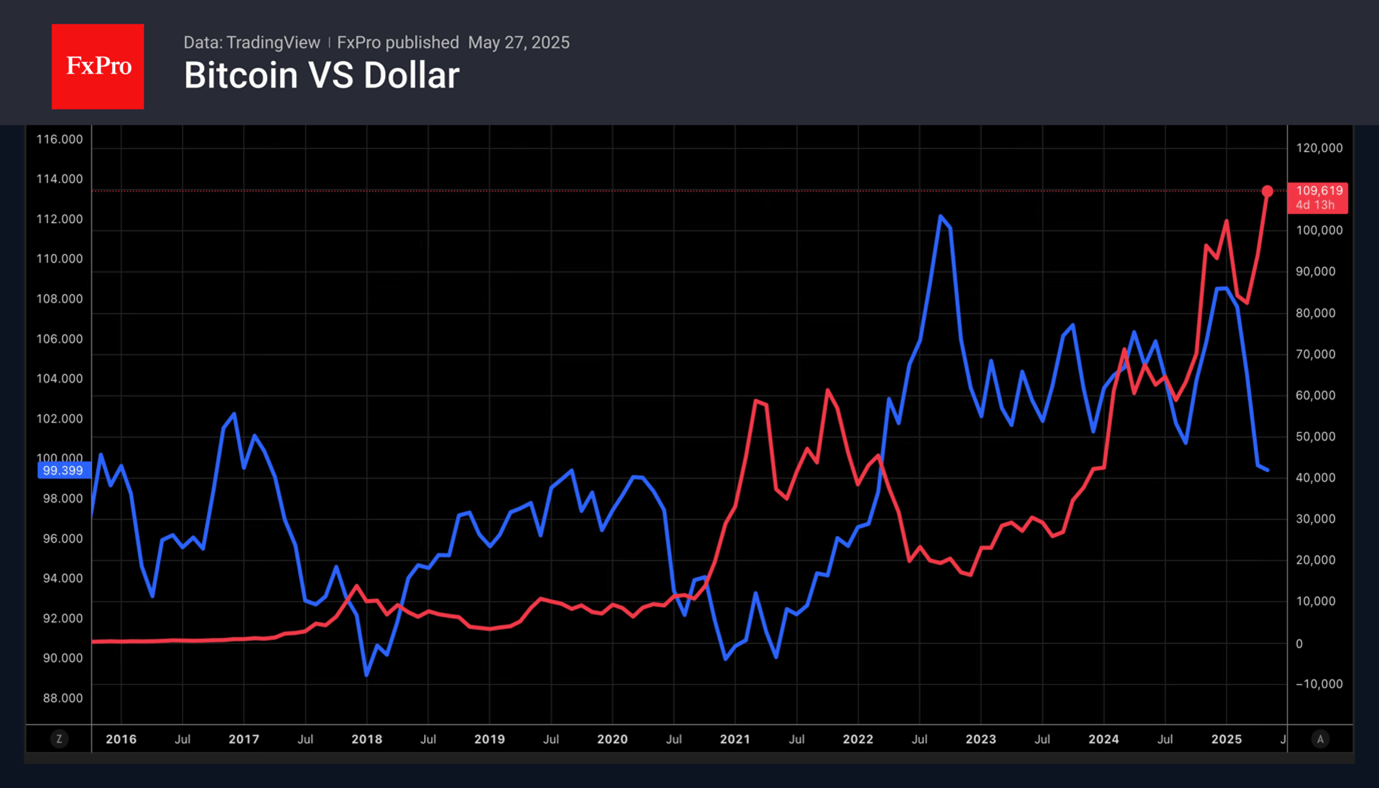

Fiscal problems and tariff confusion are undermining confidence in the US dollar. Other assets are rushing to take advantage of the loss of interest in the greenback. The ECB argues that the uncertainty of the White House policy could be a moment of glory for the euro. The regional currency can increase its share in international settlements and forex reserves. But digital assets could also benefit from the dollar’s decline.

The BTCUSD rally against the backdrop of falling US stock indices and reduced global risk appetite might look strange. Perhaps the reason should be sought in Congress’s legislation about stablecoins. The legalisation of cryptocurrency offers an opportunity to be optimistic.

However, a ‘sell America’ trade is currently reigning over the markets. Investors are getting rid of stocks, bonds, and the US dollar and looking for alternatives. They are buying European stock indices, German bonds, and digital assets. Rumours are circulating that with the passage of legislation, stablecoins could become a competitor to bank deposits as holders can earn interest via stacking. Bank of America is ready to become an issuer of dollar-linked tokens in case of legalisation.

Tether, the largest player in the stablecoin market, is still wary of Congress considering the bill. The company is worried because of the potential differentiation between the activities of American and foreign issuers. The document may not be as good for the crypto industry as it seems. Will it contain too many restrictions?

Bitcoin is consolidating due to the lack of clarity about the bill and the US stock market being closed on Memorial Day. The S&P 500 is expected to open the new shortened week higher on the back of a truce in the US-EU trade war. Rising risk appetite may help Bitcoin regain its uptrend. Markets are wagering on the so-called Trump pattern, which suggests that postponements follow tariff threats. As a result, traders have an opportunity to buy the dip.

The FxPro Analyst Team