Market Overview

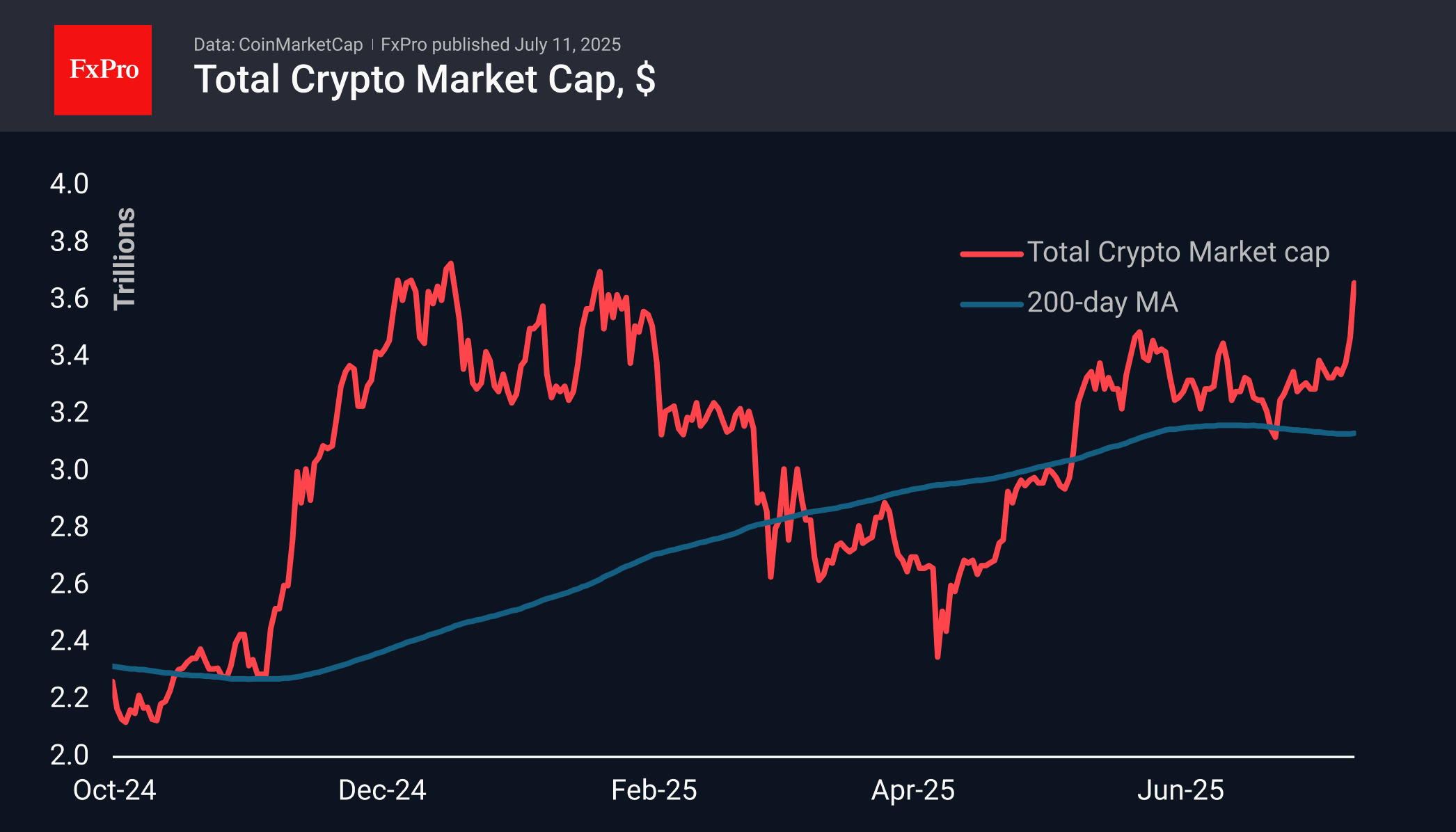

The crypto market capitalisation is at $3.66 trillion, having jumped 5.7% in the last 24 hours and approaching the record high of $3.72 trillion set in December. Risk appetite in the stock markets and Bitcoin’s record highs have drawn a wider range of altcoins into the rally, which have begun to catch up with the flagship.

Bitcoin exceeded the $118K mark for the first time in history, thanks to capital inflows into specialised exchange-traded funds and demand from companies accumulating cryptocurrency. BTCUSD was supported by improved global risk appetite. In the short term, the chances of the bulls continuing the rally look high, with a technical growth target above 135,000.

Old altcoins are being revived in light of the first cryptocurrency’s recent successes. Ethereum exceeded the $3,000 level at one point on Friday morning, above which it was last in early February. If we consider its past dynamics as a roadmap, the next areas of consolidation appear to be $3,300 and $4,000.

News Background

There is an active redistribution of roles in the digital asset market. Back in 2020, miners, offshore funds and anonymous wallets owned 95% of the bitcoins in circulation. As a result, a 2-9% increase in supply led to fluctuations in BTCUSD of 64-74%. Currently, about a quarter of tokens have passed into the hands of institutional investors. The movement of cryptocurrency is becoming more limited.

The inflow into spot Bitcoin ETFs in the US continues for the sixth trading session in a row, and for 21 of the last 22 days. According to SoSoValue, net inflows into spot BTC ETFs soared to $1.18 billion on 10 July, the highest in history. Total inflows since the approval of Bitcoin ETFs in January 2024 have increased to $51.34 billion, exceeding the $51 billion mark for the first time in history.

BTC Markets calls the achievement a ‘turning point in the institutionalisation of the asset.’ Retail investors do not drive growth; rather, they drive stable demand from asset managers, corporations, and platforms for wealthy clients.

CryptoQuant notes a jump in the ‘Coinbase premium,’ reflecting growing demand from American investors. After Strategy demonstrated a successful BTC accumulation strategy, many other companies followed suit.

The FxPro Analyst Team