Market picture

Bitcoin rose 5.3% last week to close at $23.8K. On Sunday, the first cryptocurrency was one step away from $24K, updating its high since August. Ethereum gained 0.9% to $1640. Top-10 leading altcoins have gained between 2.7% (Dogecoin) and 18.8% (Polygon).

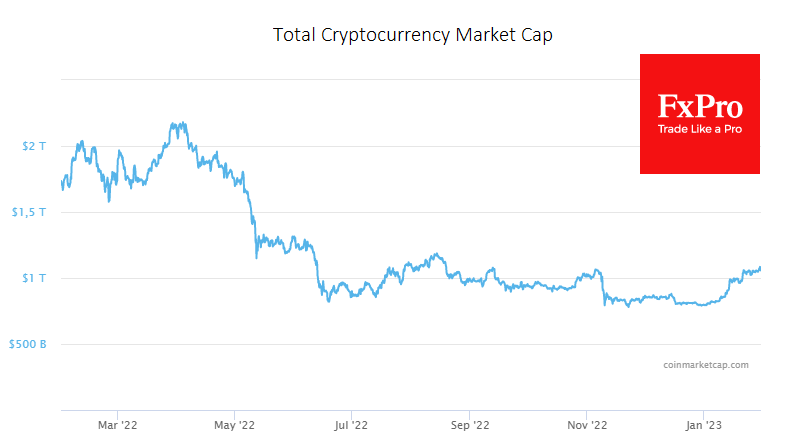

Total cryptocurrency market capitalisation rose 4.4% to $1.08 trillion over the week, according to CoinMarketCap. The cryptocurrency fear and greed index reached the greed zone for the first time since late March last year.

Bitcoin is gradually approaching its key moving averages. The 200-week is just above $24.7K, and the 50-week is now at $24.5K. A break below these levels would be a strong sell signal. A rebound above them could restore confidence in the crypto market. But be prepared for a prolonged consolidation or correction before a decisive move higher.

Polygon (MATIC) broke into the top 10 by capitalisation, taking over Solana. Over the past 30 days, the price of MATIC has increased by 52%. Ethereum’s second-tier scaling network came second by daily users, behind the BNB chain.

Another recalculation showed a 4.7% increase in the mining complexity of the first cryptocurrency. The index renewed its all-time high at 39.35T.

News Background

According to Matrixport, US institutional investors have started actively buying bitcoin, accounting for up to 85% of all purchases. Altcoins are still largely lagging but could soon overtake the top two cryptocurrencies.

According to Reuters, the US Securities and Exchange Commission (SEC) has begun inspecting Wall Street financial advisors for cryptocurrency custody services.

One of the largest rating agencies, Moody’s, is developing a scoring system to analyse the risks of stablecoins. The platform will be based on assessing the quality of collateral reports and will support up to 20 assets.

The FxPro Analyst Team