Market picture

Bitcoin has rebounded 3% in the last 24 hours to $19.3K. On Wednesday, it updated 2.5-month lows just above $18.5K before getting buyers’ support. Ethereum almost bounced back from its last dip, adding 8% to $1640.

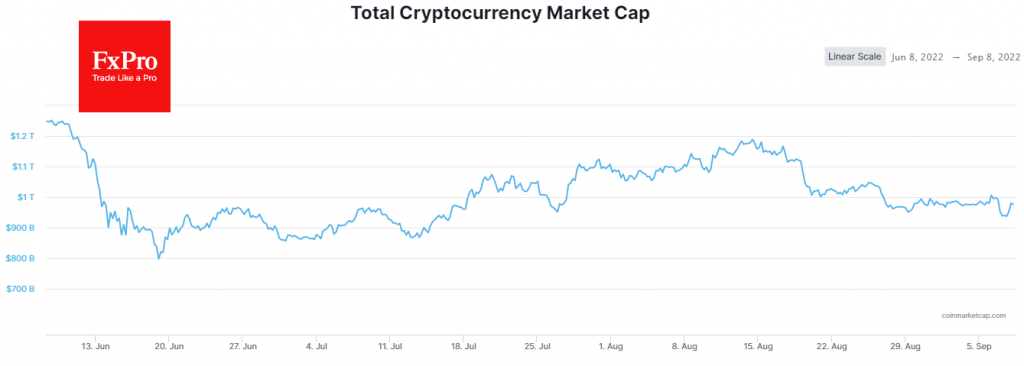

The entire crypto market has added 4.5% to $980bn over the past day, according to CoinMarketCap. The Fear and Greed Index fell to 20 by early Thursday, the lower bound of this index since July.

In the US session, the first cryptocurrency was able to turn to the upside, following equities and the general feeling that the worst moment of the sell-off is over.

While the current optimism may be premature, there is a double bottom and price divergence with the RSI chart on the BTCUSD daily chart. It will only be possible to talk about it more confidently after the week closes on the plus side and, even better, when it returns above $20K.

News background

Investments in liquid cryptocurrencies and blockchain continue to decline steadily, so don’t expect any meaningful market growth until late 2022, according to audit firm KPMG.

Arthur Hayes, former head of BitMEX, called for saving in bitcoin in the face of war and the coming crisis. According to him, BTC cannot be confiscated like any assets in banks.

According to Whale Alert, whales have started moving Ethereum to cryptocurrency exchanges. This could indicate possible asset sales on the back of The Merge’s upcoming update, which will take place in a week.

The UK’s Financial Conduct Authority (FCA) has urged citizens not to trust social media investment advice and cryptocurrency Influencers, as they will be unable to protect their rights if they lose their invested funds.

The FxPro Analyst Team