Market picture

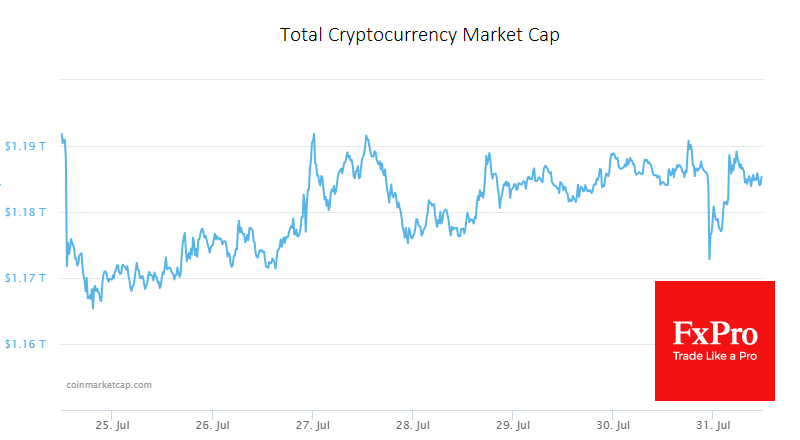

Crypto market capitalisation fell by 0.5% over the week, gradually recovering from last Monday’s dip. The Crypto Market Sentiment Index fell 5 points to 50, firmly in the middle of the scale.

For the week, bitcoin lost 1.2%, Ethereum lost 0.2%, and the top altcoins ranged from -5.7% (Polygon) to +10% (Dogecoin).

Bitcoin continues to move strictly to the right, with decreasing intraday volatility and passively closing slightly below its 50-day moving average, which is pointing up. In theory, this is a signal of a medium-term trend change. In practice, however, it may simply be market noise.

In such conditions, waiting for a significant impulse in any direction makes sense, assuming further movement in the same direction. In numerical terms, a return above $30.1K opens the way to $31.4K with a long-term target of $35.5K. A break below $29K would drop the main scenario to the near-term target of $28K and the long-term target of $27K.

News background

Well-known trader and financial industry veteran Peter Brandt believes Bitcoin will eventually become a leading investment asset. According to him, US regulators are sure to approve the launch of spot bitcoin ETFs, but this could put pressure on BTC.

Gary Gensler, head of the US SEC, said the crypto market is “rife with scammers and peddlers”. Investors starting in crypto assets should be warned that no protections exist.

The SEC has adopted new rules requiring cryptocurrency companies to disclose significant cybersecurity incidents. According to the document, companies will have four days to provide the agency with “significant” hacks details.

Despite the drop in trading volumes in the crypto market, the volume of Bitcoin and Ethereum futures transactions on the Chicago Mercantile Exchange (CME) reached record highs in January 2022.

According to CME research, tech-heavy Nasdaq 100 index fluctuations tend to affect Ethereum more than Bitcoin.

The FxPro Analyst Team