Market overview

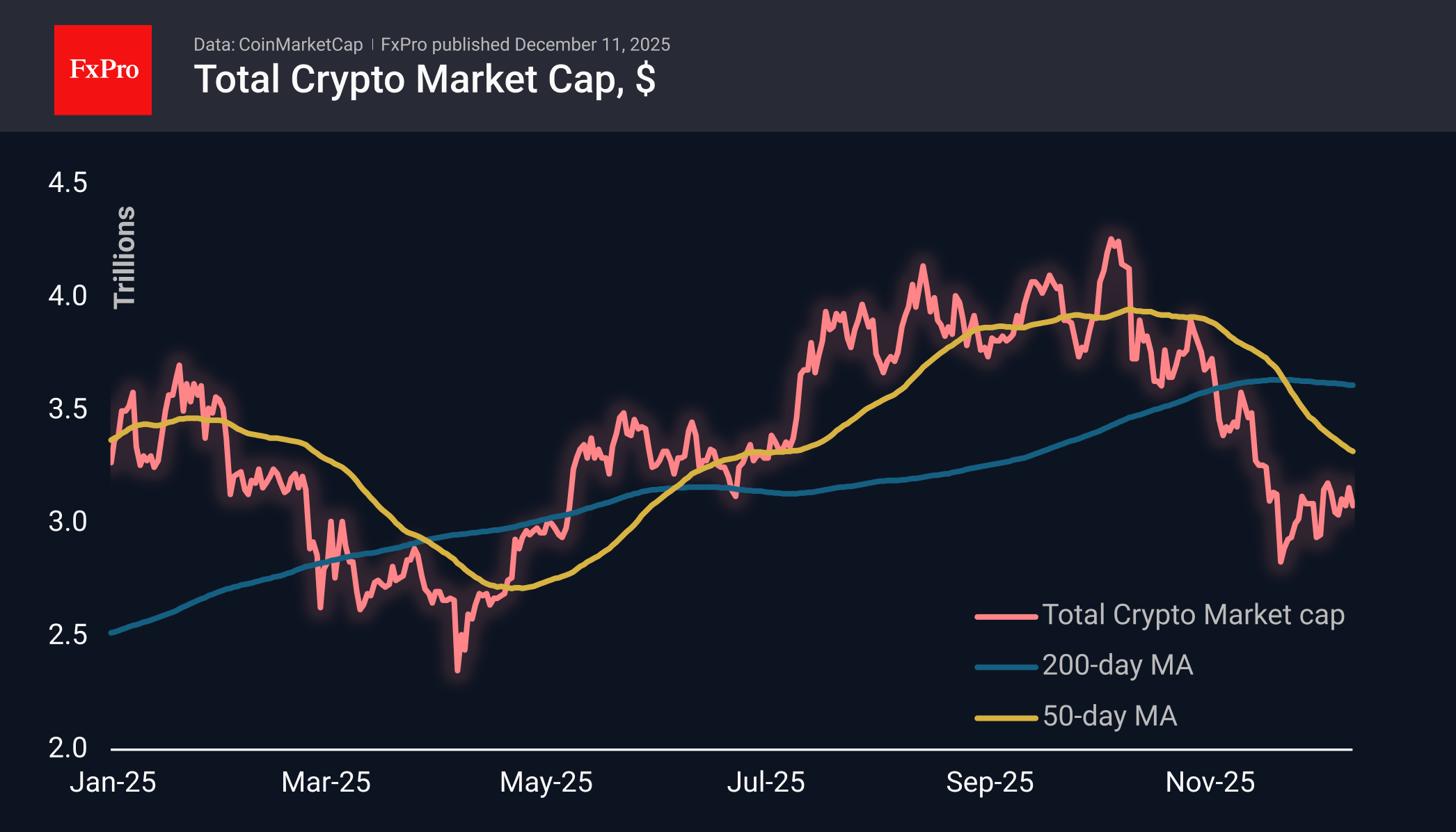

The crypto market cap has been in a see-saw pattern over the past three weeks, exhibiting a gentle uptrend that has returned to the $3.08 trillion level during a consolidation phase. With no clear trend, crypto traders have reduced their activity in altcoins, waiting for the trend to recover in the first cryptocurrency and key stock indices.

Bitcoin jumped to $94.5K on Wednesday evening in response to the Fed’s announcement of a bond-buying programme and a key rate cut. But this link to stocks played a cruel joke. The fall in Oracle shares dragged the Nasdaq-100 to eight-day lows, and BTC rolled back to $90K. The market is testing the strength of the modest uptrend that has been forming since 21 November. A drop below $88K would break this trend, bolster bearish sentiment and confirm the end of the recovery rally.

News background

Public and private companies have increased their Bitcoin reserves by 448% since the beginning of the year to 1.08 million BTC, according to Glassnode. The corporate sector remains a key driver of demand for digital gold.

ARK Invest CEO Cathie Wood believes that large companies buying cryptocurrency for long-term storage could prevent BTC from falling 75-90% as it has in the past.

Strategy founder Michael Saylor announced the company’s plans to acquire as much Bitcoin as possible. Mayside Partners believes that such plans are economically unsound. This is not innovation, but cascading leverage on speculative collateral — a model that has failed time and time again.

The American Federation of Teachers (AFT) has called on the US Senate to withdraw the cryptocurrency bill on ‘responsible financial innovation,’ which will be considered next week. The organisation pointed to the risks to pension savings and the country’s economy.

Twenty One Capital, a big Bitcoin holder, has entered the stock market. The company’s shares fell 20% on their first day of trading on the NYSE. The firm ranks third among public holders of the first cryptocurrency with 42,000 BTC (~$3.9 billion).

The FxPro Analyst Team