BTC is up 4% on Monday, ending the day around $48K, and corrected by about 1% to $47.5K on Tuesday morning. Ethereum was up 1.8% in the last 24 hours to $3.4K. Among the leading altcoins, Terra soared by 10%, Doge corrected by 2%. In most others, there is a slight correction in the growth of the last days, but they are in positive territory over the last day.

According to CoinMarketCap, the total capitalization of the crypto market increased by 1% over the day, to $2.15 trillion. The Bitcoin dominance index fell by 0.1 points to 42.1%.

The crypto-currency index of fear and greed rose by 11 points over the day, to 60, and moved from neutral level to the “greed” grade. On Tuesday, the index dropped to 56 points.

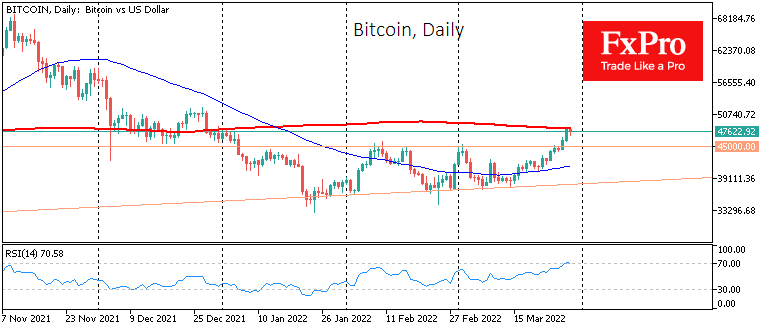

Bitcoin continued to rise on Monday after it broke through the strong resistance of the February highs around $45K in the previous evening. By the end of the day, BTC has renewed the highs of early January above $48K, having won back the decline since the beginning of the year. The growth of the first cryptocurrency rested on the 200-day moving average ($48.2K). Confident consolidation above it promises to strengthen and expand the growth of the entire crypto market and breathe fresh impetus into the growth of bitcoin. In December, we saw a false break, but then the price levels were higher, and corrective sentiment intensified in the stock markets.

Now Bitcoin is growing along with the rise of stock indices and often even acts as a leading indicator of investor sentiment. According to Arcane Research, BTC’s correlation with the S&P 500 stock indicator recently hit a 17-month high.

According to CoinShares, institutions invested $193 million in crypto funds last week, and it was the most significant amount in three months. Glassnode believes that the Bitcoin trend has already changed to bullish, as evidenced by the increase in the number of addresses accumulating BTC.

The FxPro Analyst Team