Market Picture

The crypto market has gained 0.4% over the past 24 hours. There was a fresh attempt to warm up the market with buying early Wednesday morning, but the market is avoiding acceleration in favour of a steadier rise. This is perhaps the most natural start to an uptrend, as many investors still see an opportunity to sell on the rise.

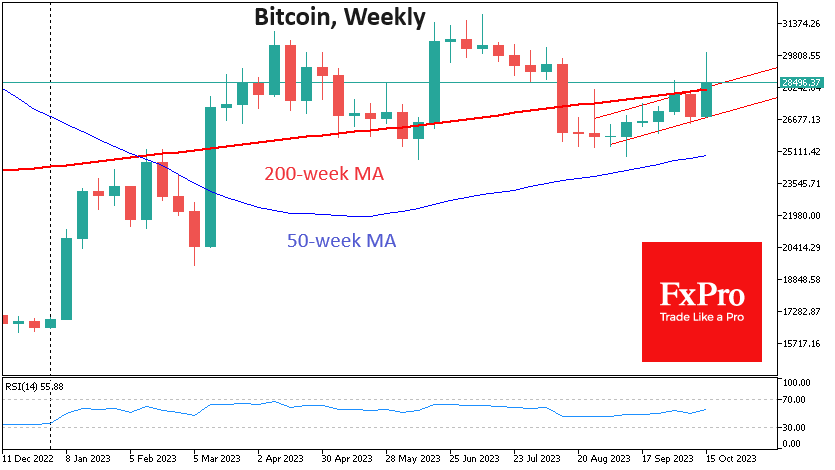

Bitcoin approached $29K again on Wednesday morning, enjoying increased demand after breaking above the 200-day moving average and the former resistance line of the ascending channel. There is now an active battle for the 200-week level, with consolidation above it at the end of the week likely to encourage further buying.

The picture in the altcoins is less optimistic. Ethereum has been making lower and lower local highs and lows for the past two weeks after coming under increased pressure following a consolidation below the 200-week average, with the 50-week average acting as local resistance. Should the pressure on the cryptocurrency intensify, the $1200 area appears to be the downside target for Ethereum.

News Background

As a result of another recalculation, the difficulty of mining the first cryptocurrency increased by 6.47%. The indicator hit a record high of 61.03 T. According to Glassnode, the smoothed 7-day moving average of the index peaked at 469.9 EH/s on 12 October.

Larry Fink, CEO of investment firm BlackRock, said that the recent rise in Bitcoin price was not related to rumours of approving a spot ETF. According to him, people tend to invest in safe assets in times of instability and geopolitical crises: government bonds and gold, to which he added the first cryptocurrency.

Ethereum’s validator queue has emptied for the first time since the Shanghai hardfork in April. This signals a stabilisation in demand for ETH stakes, according to a Coinbase report. “Validators reaching peak capacity” in recent months has reduced staking returns from over 5% to 3.5%.

FTX customers could receive $9.2 billion in claims payments by mid-2024 from the exchange undergoing bankruptcy proceedings, according to a plan approved by creditor representatives and the platform’s new management.

Online gaming platform Roblox, which has more than 200 million monthly active users, has partnered with cryptocurrency payment provider BitPay to integrate XRP as a payment method.

Binance.US no longer offers Federal Deposit Insurance Corporation (FDIC) insurance on deposits. This is according to a notice to customers seen by Decrypt.

The FxPro Analyst Team