Market picture

The cryptocurrency market fell at the end of last week. The capitalisation went down 3% in seven days to $2.21 trillion. However, it is worth noting the return of positive sentiment from Thursday, when buyers found Bitcoin attractive at $60K. The cryptocurrency fear and greed index is right in the middle, having risen out of the fear zone.

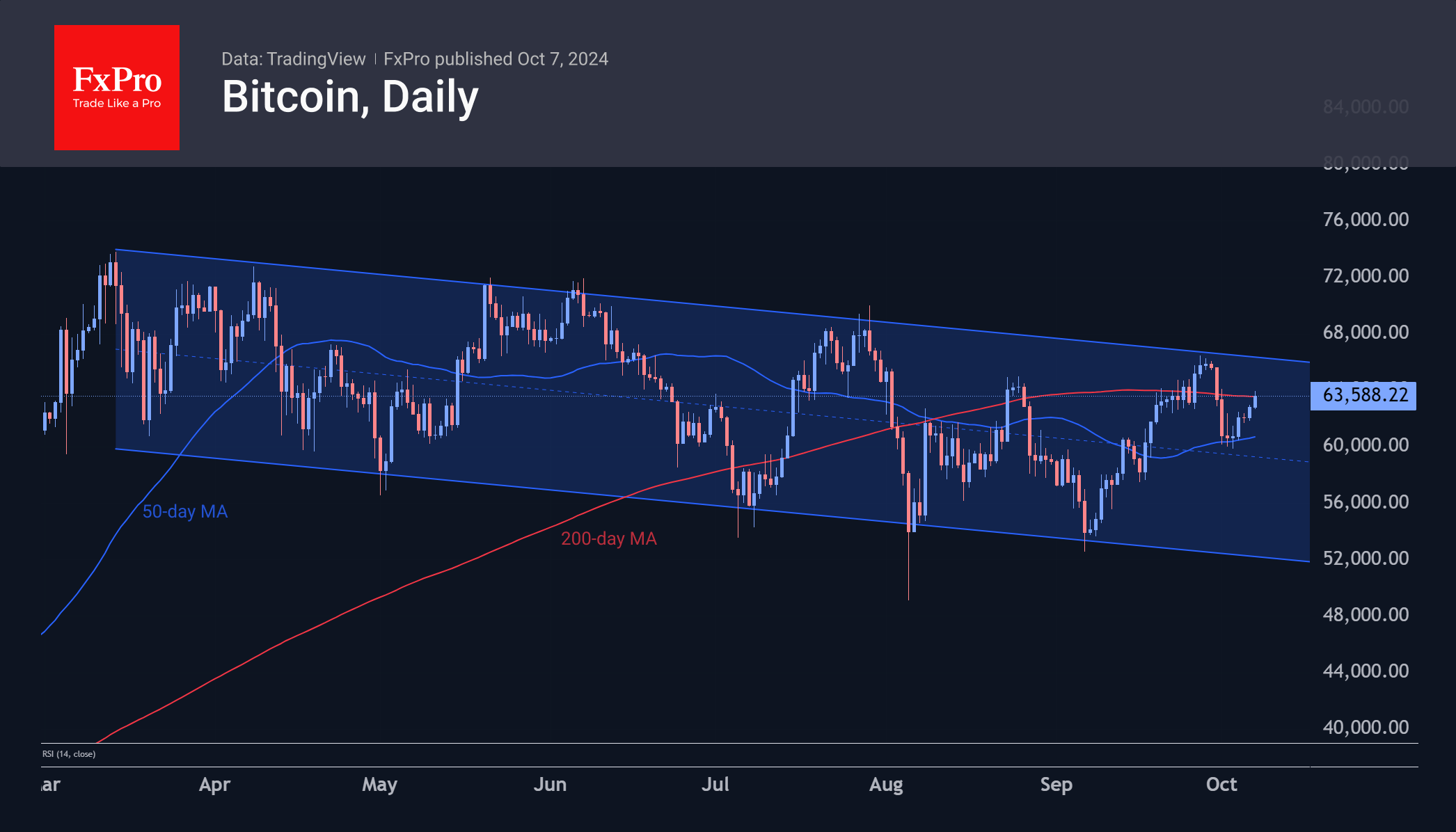

Last week, bitcoin successfully bounced out of the area where the 50-day moving average and the $60K round level intersect. The cryptocurrency’s 1.5% rise since the start of the day on Monday to $63.5K has brought the price back to test the 200-day moving average. A consolidation above would act as a bullish signal, indicating that the corrective pullback is over and buyers are taking over.

Ethereum is in a weaker position, approaching $2500 from below its 50-day average. Last week, the second-largest cryptocurrency found support at its 200-week moving average, as it has done so many times since mid-2012. That’s a good sign of accumulation by long-term buyers, but it’s sure to disappoint short- and medium-term speculators.

News background

The rise in Ethereum inflation to a two-year high of 0.74% p.a. calls into question the cryptocurrency’s deflationary prospects and its hard money status. This is the conclusion reached by Binance. The shift of network activity to L2 has led to a reduction in the number of transactions on the underlying and a decrease in the rate of coin burn.

According to SoSoValue, outflows from spot bitcoin-ETFs in the US last week totalled $301.5 million after three weeks of inflows. Cumulative inflows since BTC-ETFs were approved in January have fallen to $18.50bn. Ethereum-ETFs saw net outflows of $30.7m last week and have risen to $553.7m since product approval.

Binance continues to surrender its market-leading position. CCData calculated that Binance’s share of total trading volume on the CEX spot and derivatives markets fell to 36.6%, the worst since September 2020.

On 9 October, a new documentary will reveal the identity of Bitcoin creator Satoshi Nakamoto, who is hiding under a pseudonym. Politico admitted that the disclosure of Satoshi’s identity could shock the financial markets and affect the US presidential election.